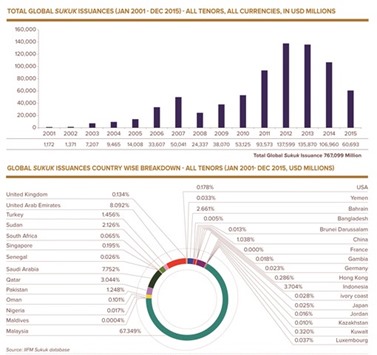

Global sukuk issuances took a hit last year and are not likely to recover in 2016, a recent report launched by International Islamic Financial Market (IIFM) in Singapore last month showed.

The IIMF, a Bahrain-based standard-setting non-profit organisation focused on the Islamic capital and money market, found that the year 2015 saw a major drop in issuances when only $60.6bn of sukuk were issued, a 43%-slump compared to 2014.

The reason for fewer issuances is mainly a dampened appetite of governments of leading Islamic finance jurisdictions in spending amid a low-oil price environment, mainly Malaysia and Saudi Arabia. In fact, a large part of the decline in sukuk issuance was due to the policy decision of Malaysia’s central bank to discontinue the issuance of short-term investment sukuk, the report notes, adding that this should not be seen as a general change of track in the sukuk market.

“The drop in sukuk issuances may not be taken as a reflection of a general weakness in the sukuk market but a change of strategy [of Malaysia]”, the report said, adding that “if Malaysia’s central bank would have continued its short-term domestic sukuk issuance as in 2014, then 2015 sukuk issuances would have been around $100bn.” This is much closer to around $110bn in sukuk issuances in 2014, meaning the rest of the sukuk market is relatively stable and kept active by the entry of new issuers such as power producing companies, project financing entities such as the Islamic Development Bank, corporations, re-issuances by sovereign issuers, and also by the entry of several new jurisdictions such as the UK, Hong Kong, Singapore, Luxemburg and South Africa, as well as by Japanese banks.

However, lower sovereign spending in leading Islamic finance jurisdictions continues to take its toll.

“We should not ignore the underlying principles which are the differentiating sukuk from conventional bonds. Sukuk are an innovative way to raise financing in a Shariah-compliant manner, and as such have strong links to the real economy,” IIFM chairman Khalid Hamad said of the effects of weaker oil income.

Despite the growing global reach of sukuk, Southeast Asia continues to be the dominant player in the market, accounting for 74% of global sukuk issuances since this type of bonds entered the global financial stage. The Gulf Cooperation Council (GCC) is the second largest issuer of sukuk with 22% of global sukuk issuances.

From a country perspective, there are just five major players that represent 93% of the market. Of the total volume of global sukuk outstanding from a country perspective, 57% is represented by Malaysia, 17% by Saudi Arabia, 10% by the UAE, 6% by Indonesia and 4% by Qatar. Behind them follows Turkey with 2%, and Bahrain and Hong Kong with 1% each.

While the IIFM does not give a forecast of sukuk issuances for 2016, rating agency Standard & Poor’s expects sukuk issuance to drop further to between $50bn and $55bn in 2016.

“We think that if oil prices remain weak, some governments of oil-exporting countries in the GCC and Malaysia may have no other choice than to reduce investment spending, resulting in lower financing needs and potentially lower issuances,” said Mohamed Damak, Paris-based credit analyst and Global Head of Islamic Finance at Standard & Poor’s.

This could, however, change in case Iran manages to enter the international Islamic finance market now that most sanctions, including on banking, against the country have been lifted. Iran has the highest market share in Islamic assets worldwide, topping out both Malaysia and Saudi Arabia, but had been cut off from the global banking system. But the Iranian banking sector needs a lot of upgrades with regards to state-of-the-art management, technology, debt analysis, governance and risk management, and its re-entry into the world of finance is certainly not going to happen overnight.

Apart from Iran, it is expected that countries such as Indonesia, Turkey, Pakistan, Bahrain, Oman, Kuwait and the UAE could become more active. Several banks in the UAE have seen a recent boom in sukuk corporate financing, and the emirate of Sharjah entered the market with a dollar-denominated sovereign sukuk in the range of $500mn this January.

..