Turkish stocks yesterday bounced 1% off eight-week lows plumbed last week and the lira steadied, but broader emerging assets remained under pressure from an increasingly gloomy global economic outlook.

A host of negatives is preying on Turkish markets, not least the departure last week of Prime Minister Ahmet Davutoglu, who is perceived as a moderate, after a tiff with President Tayyip Erdogan. That drove Turkish equities and the currency down 8% and 4.5% respectively last week .

Among other factors weighing on sentiment in Turkey is the country’s bombing of Kurdish militant targets in Iraq, the jailing of two prominent opposition journalists and the stalling of progress on a deal with the European Union that would have been advantageous for Ankara.

Tourism receipts are also falling steeply.

However, Istanbul stocks rallied after last week’s losses while the lira firmed 0.15% and credit default swaps eased from eight-week highs.

In some good news for Turkey, data showed March industrial production rose 2.9% year-on-year.

“It’s always a very volatile market and you tend to get the big adjustments very quickly when there’s a shock like a political event,” William Jackson at Capital Economics said.

He predicted the lira would weaken further, given Turkey’s current account gap of 4% of gross domestic product and high levels of external corporate debt.

Analysts at JPMorgan agreed, adding that recent political developments required a higher risk premium on the lira. They estimated that Turkish equities and bonds had attracted $1.8bn and $2.3bn respectively over the past three months and said these holdings were at risk of being unwound.

“We expect the political uncertainty to weigh on bond and equity inflows into Turkey ... Additionally, existing holdings of fixed income and equities are likely now to be at least partially FX hedged,” they told clients.

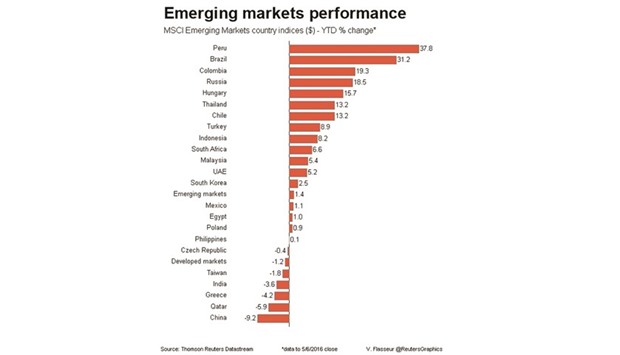

“We also see rising risks to the current account position as the summer months will reveal the hit to tourism revenues.” Broader emerging assets traded with a weak bias, with MSCI’s emerging equity index hovering just off six-week lows while the abandonment of a June rate hike in the US pushed the dollar index to one-week highs, weighing on emerging currencies.

Last week’s lacklustre US jobs report and worse-than-expected Chinese trade data have only served to deepen worries about the outlook for the world’s biggest economies. The developing world too mostly continues to post sluggish growth and poor corporate earnings.

Mainland Chinese stocks fell to eight-week lows, with the Shenzen index falling 2.1% and adding to Friday’s 3% slump and Shanghai falling 2.8% after the poor trade data. Jackson said the emerging markets recovery since February had been driven by reduced fears of a hard landing in China and by higher commodity prices.

“The Chinese export data was a bit weaker so it doesn’t suggest the economy has taken off immediately ... So perhaps the tailwinds that brought EM equities and currencies up over the past month or two are not providing a further push-up,” he said.

However there were some bright spots. Indian shares jumped more than 1% for their best gain in more than two weeks, boosted by a string of positive corporate results.

Gains were led by bank HDFC which rose 2.6% after posting a 40% surge in profit last week.

Another lender, Yes Bank, rose 3.2%.

Hungarian stocks rose 1.2% due to a 2% surge in bank OTP, a 1.8% rise in drugmaker Richter and 1.2% gains in oil group MOL, which posted better-than-expected first quarter results.