Analysts are growing increasingly confident that a near-two-year rout in oil has ended, and raised their price forecasts for a second month running last by end-April, as healthier demand and a drop in US shale output balance the market by 2017.

The inability of Opec and non-Opec producers to agree to limit oil output at a meeting earlier last month is not expected to slow the rebalancing of global demand and supply.

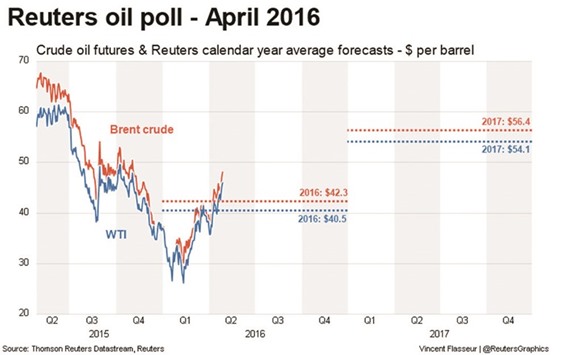

The survey of 29 analysts projected a slightly more bullish outlook, raising their average forecast for Brent crude futures in 2016 to $42.30 a barrel, compared to $40.90 in the March poll.

The March survey saw an upward revision in 2016 Brent forecasts for the first time in 10 months. Brent has averaged about $40 a barrel in 2016.

Analysts said the failure of the Qatar meeting among the world’s largest producers to reach an agreement to keep output at January’s levels has had little or no impact on prices.

“The status quo is already such that virtually all producers, except Iran, have little to no room to increase production from current levels,” said Raymond James analyst Luana Siegfried.

Since the April 17 stalemate in Doha, the oil price has rallied 21% to its highest since November.

Iran’s oil output will rise only modestly this year and next, but it will be enough to stop global supply and demand from rebalancing in 2016, according to a Reuters poll earlier this month.

“In the meantime, volatility will remain high as investors intermittently switch focus from speculation about production cuts or freezes on the one hand, and existing oversupply, on the other,” ABN AMRO senior energy economist Hans Van Cleef said.

However, a better demand outlook - with some analysts projecting an improvement by about 1mn to 1.5mn bpd - and falling US production, should keep the market on track to reach supply-demand balance next year.

..