The Middle East region “requires fiscal consolidation across the board, but needs to be phased in appropriately to minimise the adverse impact on growth,” QNB has said in its latest economic commentary.

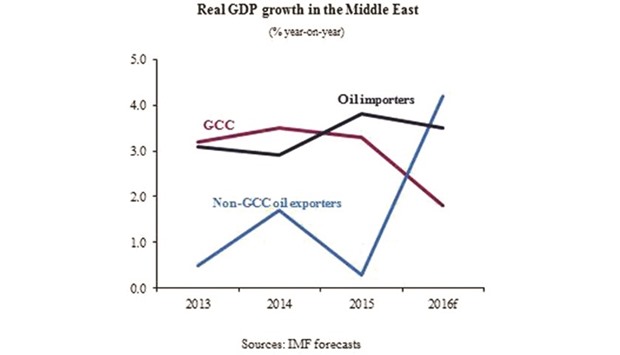

In its latest economic outlook for the Middle East, the International Monetary Fund (IMF) expects growth in the region to accelerate to 3.1% in 2016 from 2.5% in 2015.

“But the aggregate number hides some underlying disparities,” QNB said.

While the IMF expects growth among oil exporters to rise, this mostly reflects higher oil production from Iran and Iraq. Excluding this, growth in oil exporting countries is projected to slow due to lower oil prices.

Meanwhile, the IMF forecasts growth in oil importing countries to fall as the negative effects of fiscal consolidation offset the positive impact of lower oil prices.

The Middle East oil exporting countries are expected to grow by 2.9% in 2016, up from 1.9% in 2015, according to the IMF. The acceleration is mostly due to higher oil production in Iran (following the lifting of sanctions) and Iraq.

Within this group of countries, the IMF projects growth in the GCC countries to slow to 1.8% in 2016 from 3.3% in 2015. This is a result of the sharp decline in oil prices, which are hitting government revenues.

As a result, the IMF expects the total fiscal deficit among oil exporters to reach 11.6% of GDP in 2016. The deterioration of fiscal balances is leading to spending cuts, which in turn leads to slower growth.

The fall in oil prices has triggered policy measures among oil exporters to maintain fiscal sustainability. First, spending cuts have taken place across a number of countries.

In some countries capital spending has been shielded and the rationalisation of expenditure has focused more on current spending.

Second, subsidies have been reduced with further reductions expected in the coming years.

Third, initiatives to generate new sources of revenue away from hydrocarbons have taken place in some countries. In particular, the GCC is planning to introduce a value-added tax in the coming years.

Fourth, plans to privatise some state-owned companies could generate revenues for governments and increase transparency and efficiency of these companies.

For oil-importing countries, the IMF expects growth to slow to 3.5% in 2016 from 3.8% in 2015. The slowdown is expected to occur despite lower oil prices, which should benefit these countries by reducing the cost of their imports and freeing up some income for consumers to spend on other items.

But the pass-through of lower international oil prices to consumers has not been full as parts of the benefits have been saved by the government through energy subsidy removals.

This, QNB said has limited the upside from the fall in oil prices.

In addition, the fiscal consolidation taking place in most of these countries is expected to be a drag on growth. Indeed, the IMF expects the overall fiscal deficit among oil importers to decline from 7.3% of GDP in 2015 to 6.6% in 2016.

Oil importing countries also face a set of medium-term challenges, it said.

First, public debt ratios are quite high (in excess of 90% of GDP in some countries) and could threaten fiscal sustainability.

Second, oil importers still have significant external imbalances to correct. The overall current account deficit is expected to be around 4.5% of GDP in the medium term, posing devaluation risks and consequently higher inflation.

Third, some oil-importing countries face the spillovers from regional conflicts, including an influx of refugees, which have put a strain on their public services.

Finally, lower oil prices—while generally positive for these countries—can have their downside too, as they reduce potential support and remittances from oil exporters.

“Overall, the whole region is facing a number of common challenges. Fiscal consolidation is required across the board, but needs to be phased in appropriately to minimise the adverse impact on growth.

Innovative policies to generate growth and create jobs for a generally young and growing population are also needed. But these challenges present opportunities to create a more sustainable model of growth in the future, based on innovation and productivity improvement,” QNB said.

MIDEAST