Kuwait’s three oil refineries were operating at reduced rates yesterday on the second day of an open-ended labour strike.

Kuwait National Petroleum Co is processing about 510,000 bpd to 520,000 bpd, Khaled al-Asousi, spokesman for the state-oil company, said by phone yesterday. All three refineries are operating, he said. They have a combined capacity of about 900,000 bpd. A call and text message to the labour union weren’t answered.

Kuwait’s crude production on Sunday dropped to 1.1mn bpd, Saad al-Azmi, deputy chief executive for finance and spokesman at Kuwait Oil Co, said in posts on Instagram and Twitter on Sunday. Kuwait Petroleum Corp, the parent company for KOC and other operating units, will provide fuel to the local market and can meet demand from international customers for exports, it said on Twitter on Sunday. KPC and KOC spokesmen were not immediately available for comment yesterday.

The labour strike has slashed the Gulf nation’s output by 60%, shuttering 1.7mn bpd - slightly more than the surplus sloshing around world markets in the first half of the year. That oversupply caused prices drop to a 12-year low in January.

“If the potential loss of Kuwaiti crude supply is sustained long enough, that is roughly equivalent to current estimates for the global stockpile build in the second quarter,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas. “Of course, there is a big ‘if’ in terms of how long the strike will last.”

Kuwait is among Middle Eastern oil producers that are cutting spending and benefits to plug holes that the oil-price drop of nearly 30% in the past year has punched in government budgets. Prices have fallen as rising output from the Organization of Petroleum Exporting Countries and other suppliers has created a global glut. Kuwait produced 2.81mn bpd last month, making it Opec’s fourth-largest member, while worldwide supply exceeded demand by 1.6mn barrels in the first quarter, according to the International Energy Agency.

The plunge in Kuwait’s output “is just shocking,” Edward Bell, a commodities analyst at Dubai-based bank Emirates NBD, said Sunday by phone. “That would take care of the surplus right there. In this market that is so driven by sentiment, for sure it will have an impact on price.”

The disruption came as output talks on Sunday between the world’s biggest producers ended without any agreement on limiting supplies.

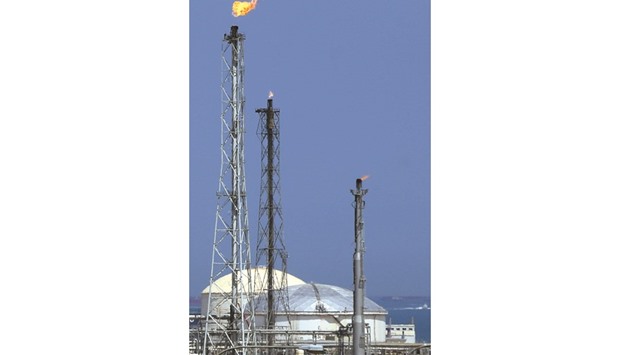

A general view of the Shuaiba oil refinery south of Kuwait City. The labour strike has slashed the Gulf nation’s output by 60%.