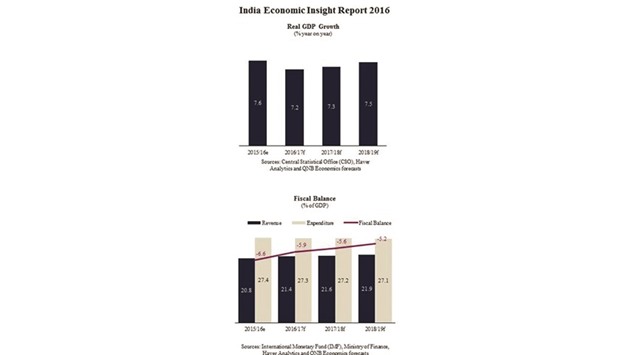

QNB expects India’s real economic growth to accelerate from 7.2% in 2016-17 to 7.3% in 2017-18 and 7.5% in the subsequent year as domestic reforms are implemented.

Key reforms include unifying goods and services taxes, restarting stalled investment projects and restructuring the banking system, QNB said in its ‘India Economic Insight 2016’.

“Reforms and higher foreign ownership limits should encourage the participation of foreign and private investors,” it said.

Although inflation is expected to harden to 5.2% this year, then moderate thereafter on lower food prices; QNB said several temporary factors — such as higher rent inflation due to higher public sector allowances; higher power tariffs; and an increase in the services tax rate — are expected to increase inflation in 2016/17.

Highlighting that the other factors should keep inflation low over the medium term; it said a normalisation of harvests should lower food inflation; oil prices should remain moderate; and set a new inflation target of 4%.

QNB found that fiscal consolidation is planned to continue with the deficit narrowing from an estimated 6.6% of GDP (gross domestic product) in 2015-16 to 5.2% in 2018-19.

Expenditure is expected to fall slightly as lower current spending (mainly due to subsidy cuts on food) offsets higher spending on infrastructure investment; while revenue should expand owing to higher excise duties, an increase in the services tax rate and proceeds from telecommunications auctions and privatisations.

Growth in the banking asset is expected to slow to 9% in 2016-17 before picking up to 10% in 2017-18 and 11% in 2018-19 as state banks’ balance sheets are cleaned up and the sector is recapitalised.

In 2016-17, the country’s banking regulator Reserve Bank of India is expected to press lenders address non-performing loans, which could be a drag on growth and profitability, QNB said, adding the government plans to inject $10.4bn into state-owned banks over the next four years, frontloaded to 2016-17.

QNB