The International Monetary Fund’s (IMF) steering committee on Saturday urged member countries to boost “growth-friendly” spending and said the Fund should explore new lending tools to help deal with slowing global growth.

IMF Managing Director Christine Lagarde said that calmer markets since February had reduced the stress level at the IMF and World Bank spring meetings here, but the outlook was still fraught with downside risks from weak demand, a potential UK exit from the European Union and low oil and commodity prices.

“There was not exactly the same level of anxiety but I think there was an equal level of concern, and a collective endeavour to identify the solution and the responses to the global economic situation,” Lagarde told a news conference.

She described the gatherings, along with a Group of 20 finance ministers and central bank governors meeting on Friday, as “collective therapy” to deal with the gloomy prospects.

The IMF cut its global growth forecasts earlier this week for the fourth time in a year.

The International Monetary and Financial Committee (IMFC) said in its statement: “Downside risks to the global economic outlook have increased since October, raising the possibility of a more generalized slowdown and a sudden pull-back of capital flows.”

Echoing sentiments from the G20 statement, the 24-member IMFC said countries should “refrain from all forms of protectionism and competitive devaluations, and to allow exchange rates to respond to changing fundamentals.”

The committee said a more “forceful and balanced policy mix” was needed to stimulate growth and avoid deflation and emphasised that monetary policy alone was not enough.

“Growth-friendly fiscal policy is needed in all countries,” it said, adding that accommodative monetary policies should continue in several advanced economies and structural reforms should be implemented with policies that support demand and help displaced workers. Swiss National Bank Chairman Thomas Jordan said he thought the need for more fiscal stimulus and structural reforms in Europe, Japan and China was finally sinking in with policymakers

“This is easier said than done,” he told a news conference. “These structural reforms are difficult to pass through parliaments...there is a certain risk that this will be postponed.” The committee called on the Fund to review its lending tools “to explore ways to strengthen its approach to helping members manage volatility and uncertainty - including through financial assistance, also on a precautionary basis.”

The statement gave membership backing to Lagarde’s campaign for a stronger global financial safety net - a broader set of precautionary financing tools such as IMF credit lines that would reduce reliance on costly reserves for many emerging markets.

The panel, chaired by Mexican central bank governor Agustin Carstens, also said that a new formula for the Fund’s voting shares, due for completion by October 2017, is likely to increase the share of emerging market and developing countries.

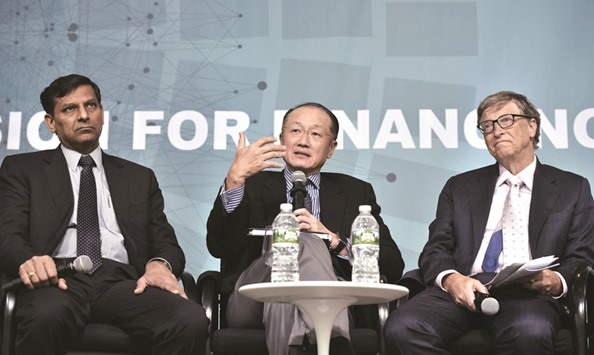

World Bank President Jim Yong Kim (centre), flanked by Reserve Bank of India Governor Raghuram Rajan (left) and Microsoft co-founder Bill Gates, speaks at a forum on financial development during the annual International Monetary Fund, World Bank Spring Meetings in Washington, DC. The IMF’s steering committee on Saturday urged member countries to boost ‘growth-friendly’ spending and said the Fund should explore new lending tools to help deal with slowing global growth.