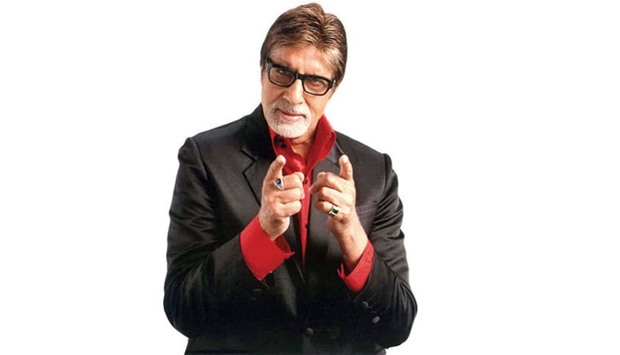

Bollywood mega star Amitabh Bachchan is among 500 people from India who feature in a massive leak of documents, some of which reveal hidden offshore assets, reports said yesterday.

Bachchan, simply known as the “Big B”, was appointed director of at least four shipping companies registered in offshore tax havens and set up 23 years ago.

The authorised capital of these companies ranged from just $5,000 to $50,000 but they traded in ships worth millions of dollars, according to the Indian Express newspaper.

The Express is among more than 100 media groups which have investigated a massive leak of 11.5mn documents from Mossack Fonseca, a Panama-based law firm with offices in 35 countries.

Bachchan, who has long since resigned from the companies and has not commented on the documents, is not the only member of his famous family named in the leaks.

His daughter-in-law, actress Aishwarya Rai Bachchan, was also director and shareholder of an offshore company, along with members of her family, before it was thought to have been wound up in 2008, according to the newspaper.

The media adviser of the former Miss World winner has rejected the documents as “totally untrue and false”.

As with many of Fonseca’s clients, there is no evidence that the Bollywood A-listers used their companies for improper purposes and having an offshore entity is not illegal.

In 2004, India legally allowed investments abroad by companies, and later individuals, through the Liberalised Remittance Scheme.

Also named were Sameer Gehlaut of India Bulls, for properties owned by Bahamas, Jersey and the United Kingdom, and K P Singh of DLF about companies registered in British Virgin Islands.

Vinod Adani, the elder brother of industrialist Gautam Adani, and politician Shishir Bajoria from West Bengal and Anurag Kejriwal of Loksatta Party were also alleged to have set up companies in tax havens. Bajoria told the Indian Express that that “erroneous beneficial owner information” was given by mistake.

The Express said it had carried out the investigations spread over eight month with several global newspapers. Many of the other persons named in the Express reports responded, some denying while others maintaining that they had worked within the laws of the country.

But the documents come at a sensitive time in India.

Prime Minister Narendra Modi’s government has vowed to crack down on the “menace” of so-called black money - vast sums stashed abroad to keep them secret from Indian tax authorities.

The government said it will investigate the allegations.

“Unlawful financial holdings abroad will face action,” Finance Minister Arun Jaitley said in Delhi.

“On the prime minister’s advice, we have constituted a multi-agency group to monitor all the information and to collect further information in this regard,” he said.

The panel comprises the Central Board of Direct Taxes and representatives of the Reserve Bank of India.

Jaitley earlier said Indians who did who did not utilise a government scheme to reveal their illegal assets stashed abroad will find such “adventurism extremely costly.”

The government is under pressure to reveal and recover black money, among the key poll promises made by Modi during his election campaign in 2014.

Jaitley, meanwhile, welcomed the expose.

“It appears in the next few days more names are going to come out,” the finance minister said.

“I have been repeatedly saying that the world is going to become increasingly more transparent,” he said. “Countries are co-operating with each other and slowly all this information is going to come out as a result of various global initiatives which have been launched.”

Last year, India signed the Convention on Mutual Administrative Assistance in Tax Matters under the Common Reporting Standard multilateral agreement to automatically exchange financial information.

At the G20 nations’ Australia summit in 2014, leaders endorsed a new global transparency standard by which more than 90 jurisdictions would begin automatic exchange of tax information, using a common reporting standard by 2017-18.

The deal will allow the countries to extract bank details for future and also make available account balance information of the past five to six years upon request.

Indian officials have said the tax department is now more actively pursuing penalties and prosecutions with better access to information allowed by FATCA and the taxation agreements with 96 countries.