US Department of Justice officials have asked Deutsche Bank AG and JPMorgan Chase & Co to provide details on their dealings with 1MDB, as global investigations into the troubled Malaysian state fund widen.

US Department of Justice officials also travelled to Kuala Lumpur to speak to senior bankers and other people with close links to the state fund, three people with direct knowledge of the matter told Reuters.

They said JPMorgan and Deutsche were not the target of investigations at this stage, but had only been asked to provide details.

Deutsche Bank and JPMorgan declined to comment.

The Department of Justice also declined to comment.

The US move marks the latest development in a wide-ranging global investigation across three continents into possible corruption and money-laundering at 1MDB, whose advisory board is chaired by Prime Minister Najib Abdul Razak.

Najib has denied any wrongdoing and said he has not taken any funds for personal gain, but opposition leaders and government critics have stepped up calls for him to resign.

The sources spoke on condition of anonymity as they were not authorised to speak to the media.

It was unclear how long the US officials were in Kuala Lumpur, or whether they had completed their visit.

A team of lawyers for Deutsche Bank are in Kuala Lumpur preparing the report they intend to submit to the Department of Justice, one of the sources said.

Malaysia’s attorney general, who was hand-picked by Najib, cleared him of all criminal offences in January, declaring that $681mn that were deposited into his personal bank accounts were a gift from Saudi Arabia’s royal family.

The Wall Street Journal reported in March that more than $1bn was deposited in Najib’s account and global investigators believe much of it originated from 1MDB.

The fund has consistently denied these claims and repeated again on Thursday that no 1MDB funds went into the prime minister’s personal accounts.

Deutsche Bank is one of the many global lenders who had dealings with 1MDB, as the energy-to-real estate group expanded rapidly after its inception in 2009.

The bank provided a $975mn loan for 1MDB in late 2014, which was repaid last year.

The German bank was also advising the fund on a proposed $3bn initial public offering of its energy assets, which never took place.

JPMorgan normally acts as a US clearing bank for lenders operating in Malaysia. Its dealings if any with 1MDB were not immediately clear.

The US government is already reviewing Goldman Sachs’ relationship with the Malaysian fund.

A Federal Bureau of Investigation (FBI) team specialising in “international kleptocracy” is leading the bureau’s inquiries, a person familiar with the matter told Reuters last year.

Goldman came under fire for the fees it charged for helping 1MDB raise funds through bond offerings.

The fund racked up borrowings of about 42bn ringgit ($11.5bn), before selling off assets in 2015 to pay down debt.

Officials at Goldman have declined to comment.

Other international banks that have dealt with the fund are also facing questions.

Singapore’s central bank said yesterday that it had asked financial institutions to provide details of any transactions linked to 1MDB, without identifying any lenders by name (see accompanying report).

The burgeoning 1MDB scandal has rocked Najib’s government as public outrage over the alleged mismanagement and corruption grows.

The scandal has fuelled a sense of crisis in a country under economic strain from slumping oil prices and a prolonged slide in its currency last year.

Mahathir Mohamad, Malaysia’s longest-serving leader and once Najib’s patron, has become his fiercest critic and is leading a campaign to oust the prime minister with the support of some opposition leaders.

Mahathir quit the long-ruling United Malays National Organisation party, and joined hands with long-standing foes to crank up pressure on Najib to quit.

Along with the United States and Singapore, other countries are conducting investigations.

On Thursday, Luxembourg’s state prosecutor launched a judicial inquiry into allegations of money laundering involving hundreds of millions of dollars against 1MDB.

This follows a similar inquiry by Swiss prosecutors, who said earlier this year they had identified four cases of alleged criminal misconduct in the suspected misappropriation of about $4bn from Malaysian state companies.

Malaysia’s central bank also said it would pursue administrative action against 1MDB for missing a deadline to submit documents on its finances abroad.

Singapore seeks bank details on Malaysian funds investigation

Singapore’s central bank confirmed yesterday that it has asked a number of banks to provide information on fund flows as part of a probe into possible money-laundering related to Malaysian state firm 1MDB.

The Monetary Authority of Singapore (MAS) issued a statement following a report by The Australian newspaper saying that it has asked about 40 banks with operations in the city-state to provide information on the matter.

“MAS is able to confirm that as part of its investigations into possible money-laundering and other offences in Singapore, it has been conducting a thorough review of various transactions as well as fund flows through our banking system,” the central bank said. “MAS has requested a number of financial institutions to furnish information relating to the review.”

It also said it was working closely with authorities in other financial centres because of the cross-border nature of the fund flows.

“Besides any enforcement actions by the relevant authorities in Singapore for possible violations of our laws, MAS will not hesitate to take regulatory actions against financial institutions should they be found to have breached our banking rules,” MAS said.

Transfers of as little as A$50,000 ($38,365) are believed to be under scrutiny by the MAS, which is investigating whether the haul was split into small amounts in a bid to escape notice, The Australian said.

Singapore said in February that it had seized “a large number of bank accounts” as part of investigations into 1MDB as authorities vowed not to let the city-state become a refuge for illicit funds.

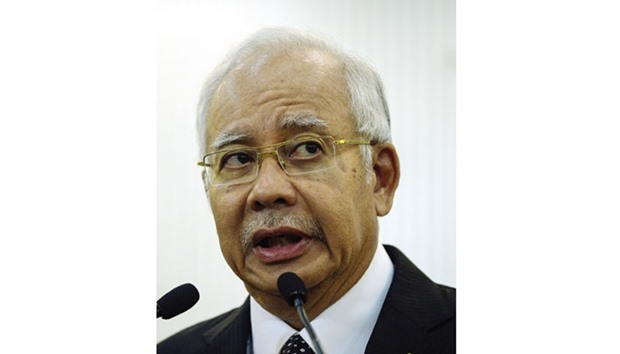

Najib: facing calls to quit.