Emerging market equities fell yesterday, snapping a four-day winning streak as the impact of a Japanese equity rout offset stronger factory data from China and Eastern Europe.

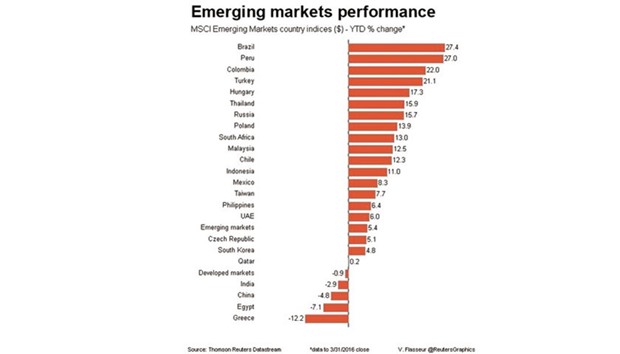

MSCI’s benchmark emerging stocks index was down 1.2%, mirroring a broad-based sell off in developed markets led by Japan, after a manufacturing survey there found sentiment at its lowest in nearly three years.

That comes after the index posted its best quarterly performance since mid-2015. Most emerging Asian bourses fell around 1% and currencies across the region weakened.

Manufacturing activity in some of the biggest emerging economies – Russia, Turkey and South Korea - disappointed, though China posted growth for the first time in nine months and its services also unexpectedly improved.

Polish manufacturing activity bucked the trend, expanding at the fastest rate in eight months in March. The Czech and Hungarian surveys stayed in positive territory.

The Polish zloty firmed 0.2% to touch a three-month high against the euro and the Hungarian forint rose 0.16%.

Credit Suisse economist Mikhail Liluashvili said the data provided more evidence central Europe had broken away from broader emerging markets.

“Central European PMIs (Purchasing Managers’ Index) confirm that growth continues to be solid across the region, especially in Czech and Poland,” he said.

Regional stocks failed to benefit, with the Warsaw bourse down almost 1%. Liluashvili attributed this to the global backdrop and Polish banking problems.

Stocks’ lurch into negative territory was accompanied by bearishness on commodities, with oversupply concerns keeping oil around $40 per barrel.

The Russian rouble fell more than 1% against the dollar, off four-month highs which it hit earlier, thanks to dollar weakness.

The dollar index hit its lowest since mid-October on Thursday, after US Federal Reserve head Janet Yellen signalled the Fed would tread cautiously on raising interest rates.

March US jobs data due later on Friday may provide further clues as to the strength of the US economy and the pace of future rate increases.

The South African rand firmed 0.5%, holding at around four-month highs, after South Africa’s top court ordered President Jacob Zuma to reimburse the state for the refurbishing of his home.

“The (court) ruling will apply more pressure on President Zuma and increases the chances of a future impeachment, or at least of him losing control of the succession process,” analysts at BNP Paribas said in a note.

“Nonetheless, this one ruling is unlikely to lead to any dramatic actions by itself,” they added, predicting that the rally would prove to be short-lived.