Embattled tycoon Vijay Mallya has proposed to repay Rs40bn ($603mn), less than half of what his defunct Kingfisher Airlines owes to creditor banks who have approached the nation’s highest court to recover their dues.

Mallya, who left India on March 2 and whose exact whereabouts since then are not known, made the offer yesterday to the group of lenders led by State Bank of India to pay the sum by end-September.

A lawyer for Kingfisher, C S Vaidyanathan, yesterday submitted the repayment plan to the Supreme Court. The court sought the banks’ response within a week to the proposal. It will hear the case next on April 7.

“It is for you to tell us whether you reject this or not,” Justice Rohinton Nariman told the banks. Justice Kurian Joseph then asked whether Mallya is back in India. “Where are you? Are you back in India?” Kurian asked.

“No. The media has vitiated the atmosphere. The atmosphere is so surcharged against me... There are cases in which media created such a surcharged atmosphere that even beatings have taken place... the less said the better,” Mallya’s lawyer Vaidyanathan responded.

“The media ultimately stands for the public interest. They just want the money taken from the banks to be brought back...” Justice Kurian shot back.

Separately, the SBI, the nation’s top lender, said it had received an offer for “settlement of dues” and was examining the offer.

The court also heard that Kingfisher representatives had communicated with the banks via video conference, but lawyers representing the banks said the lenders wished to meet with Mallya in person.

A lawyer for Mallya said he was not in the country and that “in the present ambience (it was) not needed”.

Kingfisher, once India’s second-biggest airline, ceased operations more than three years ago after a stretch of losses, leaving creditors, suppliers and employees with unpaid dues.

As of last November, it owed the group of banks about $1.4bn including interest and fees.

A spokesman for Mallya’s UB Group did not immediately reply to an e-mail seeking comment on whether Rs40bn is all Mallya wants to pay the banks or it is the first installment of repayment.

The creditor banks stepped up pressure on Mallya - who gave a personal guarantee for the Kingfisher loan - after he agreed to a $75mn settlement with Britain’s Diageo Plc last month to give up his chairmanship and board position at top Indian spirits maker United Spirits Ltd. After stepping down, Mallya said he would spend more time in England where his children live.

Once known as the “King of Good Times” for his extravagant lifestyle, Mallya has denied that he had fled India and said he would comply with local laws. Media reports have traced him to the Hertfordshire village of Tewin, north of London, where he owns a house.

His surprise departure has proved an embarrassment for the government, which was forced to admit he had left the country even as it sought permission to impound his passport.

Opposition politicians have demanded to know why the 60-year-old was not arrested before he flew out on March 2.

India’s financial crimes agency has also summoned Mallya in connection with an alleged case of loan fraud involving state-run IDBI Bank in Mumbai.

The businessman, who is also a member of the Rajya Sabha, the upper house, has criticised the media for what he has called a “witch hunt”.

Mallya’s case has taken centre stage at a time when the central bank and the government have begun a crackdown on bank loan defaulters to clean up the nation’s ailing state-run banks. Finance Minister Arun Jaitley has said the government had asked banks to go “all out” in their effort to recover money from Kingfisher.

“I don’t want to make any comments on individual cases but I think it’s a responsibility of large groups like his (Mallya’s) to honourably settle their dues with the banks,” he said last week.

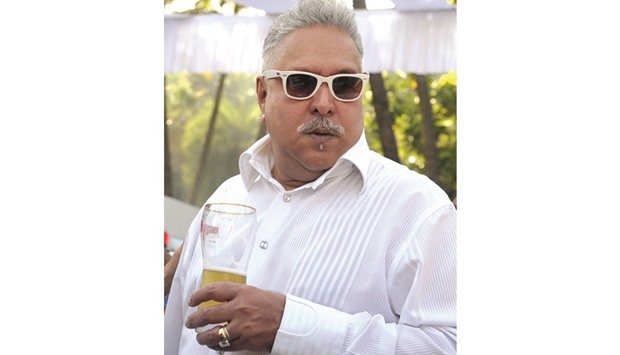

Mallya: offers to repay $603mn