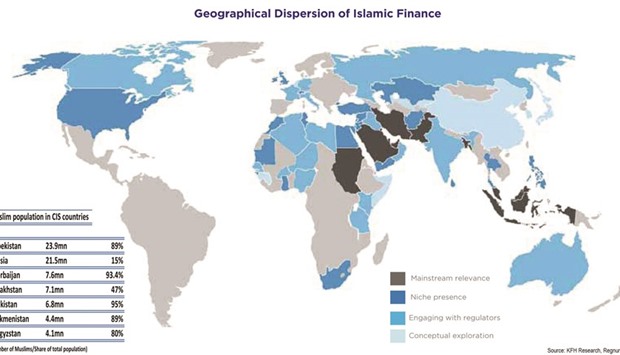

Islamic finance is gaining momentum in developing economies around the world due to its asset-based structure, which makes it easier for cash-strapped nations to gain access to capital, as well as owing to its well-regarded ethical approach. The latest region seen as having big potential for Islamic finance is the Commonwealth of Independent States (CIS), comprising eight countries plus Russia that until 1991 were part of the Soviet Union. Being home for a large Muslim population, especially in Central Asian CIS member states, the area is emerging as a new frontier region for Islamic finance as banking penetration is relatively low and demand for financing is strongly growing.

Of the total CIS population of around 287mn people; Azerbaijan, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan stand out by having a Muslim population share between 80% and 95% each. Adding to that, since the dissolution of the Soviet Union, the CIS countries experienced solid GDP growth rates at an average of 8% annually, and Azerbaijan and Turkmenistan, in particular, were among the five fastest-growing economies in the world between 2000 and 2012.

In all these countries, growth is strongly dependent on production and export of commodities, not just oil and gas, but also coal, iron and precious metals, among others. This brings with it the need for huge infrastructure investments for the production cycles of those commodities, and also for processing and transportation, e.g. for pipelines, railway networks, roads and ports. Adding to that, the large “underbanked” Muslim population in the region indicates another big opportunity for Islamic finance.

However, most CIS states have only recently begun to introduce first draft regulations and proposals to embark on Islamic finance and will need further assistance and time to create legally functional frameworks for the sector. This February, the inaugural Commonwealth of Independent States Global Business Forum (CIS GBF 2016) was held in Dubai with the aim to further develop Islamic finance structures and tap into Islamic finance as a financing tool for economic diversification in CIS countries “to prepare them for the post-oil age and to enhance their financial competitiveness,” according to Behnam Gurbanzada, Islamic finance consultant and member of the Azerbaijan-CIS Islamic Banking Advisory Council.

“Islamic Banking can play a big role in financing core facilities advancement, farming and other growth sectors in the CIS,” he said, adding that “strategies are afoot to introduce Islamic banking regulations” in Azerbaijan, whose population consists of 93.4% Muslims.

Prasad Abraham, CEO of the Kazakhstan branch of Abu Dhabi’s Al Hilal Bank, said at the forum that while his bank was a “first mover in Islamic banking in the CIS area,” growth of its Islamic banking services to other CIS nations has been limited so far since “legislation has actually not reached the level that is acceptable.”

In a nutshell, both Kazakhstan and Azerbaijan at present have the best prerequisites to increase the share of Shariah-compliant banking in their countries. In Kazakhstan, Zaman Bank is in the process of becoming the second fully-fledged Islamic bank in the country after Al Hilal Bank, and there are plans to establish the newly established Astana International Financial Center as a leading hub for Islamic finance in the region.

Last year, the Kazakhstan Stock Exchange signed a partnership with Nasdaq Dubai to cooperate in the Islamic capital market sector. In Baku, the International Bank of Azerbaijan recently opened an Islamic window and has also started offering Shariah-compliant finance services to Russian customers via its Moscow branch. Another aspiring nation is Kyrgyzstan, where pilot projects for Islamic finance for retail customers, as well as Islamic microfinance initiatives have been launched in the recent past.

ISLAMIC