Qatar is one of the lowest cost producers of LNG in the world, which allows the country to remain profitable in the current pricing environment, an industry analyst has said.

Peter Lee, Asia Oil & Gas analyst at BMI Research said Qatar is the leading producer of LNG globally, exporting 103 bcm in 2015, equivalent to 82.7% of the emirate’s total natural gas exports.

Asia, he said, would remain the “dominant importer” of Qatari LNG over the decade. However, in a buyer’s market Qatar will have to show increased flexibility in its contract negotiations to maintain its position in the region, Lee told Gulf Times yesterday.

“Asia has historically been the largest offtaker of Qatari LNG. However, in 2015, the volume of exports to Europe started to increase again, at the same time as Qatar reduced its exports to Asia,” Lee said. This move to Europe was, in BMI’s view, a response to weak demand in core North East Asia markets notably Japan and South Korea.

“We believe that Qatari LNG exports to Europe will remain elevated historically in the coming two to three years. In particular, the outlook for demand in Japan looks sluggish, as nuclear capacity comes back online and due to a dampened macroeconomic outlook,” Lee said.

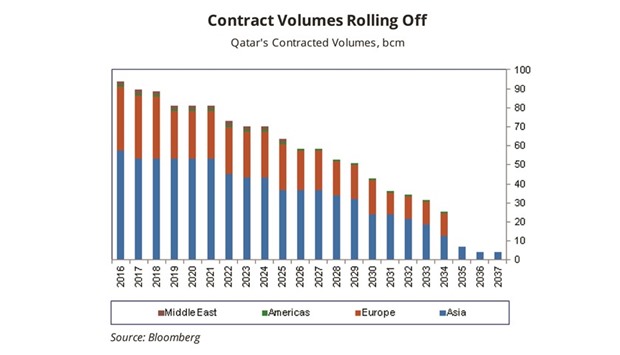

The ability of Europe to absorb these excess volumes will be increasingly tested, due to weak demand growth in the European power sector, coupled with increased competition from new exporters, primarily the US. Post-2016, he said, Qatar does not have any new contracts coming into force and with 30.1bcm of contracts rolling off in the next ten years, and will have to start negotiating new contracts to secure long-term offtake.

Despite the demand weakness in South Korea and Japan, BMI expects Asia to remain the dominant consumer of LNG, driven by strong growth in emerging markets such as China and India. As such, it will remain a key target for Qatar.

According to BMI’s Japan Korea Marker (JKM) forecast, the Asian LNG price benchmark will collapse in 2016 and 2017, as global oversupply drives down prices.

“We expect price weakness to remain weak for the coming five years, despite a modest recovery in 2019 and 2020. Price weakness creates a buyer’s market, eroding the negotiating power of Qatar. Reduced bargaining power will lead to terms that favour the Asian consumer, in particular through more flexible contract terms.

“Major changes we expect to occur include a relaxation of destination clauses, a shift to cargo-by-cargo contract models and more generous price re-opener clauses. In addition, a larger share of the contracts will be short and medium term rather than historically preferred long-term contracts,” Lee said.

‘Australia may overtake Qatar as largest LNG exporter by 2019’

Australia is set to “overtake Qatar” as the largest LNG exporter in the world by 2019, said Peter Lee, Asia Oil & Gas analyst at BMI.

Asked whether Australia would turn to energy-deficit and large countries such as India to seal supply contracts, Lee said, “If all projects under construction and in the proposed phase go ahead as planned, India’s LNG import capacity could double from around 25mn tonnes per year currently to more than 50mn tpy by 2018-19.

“However, India only has around 17mn tpy of supply contracts in place to 2019 (predominantly with Qatar). While typically India has relied on spot purchases to meet import needs, a lot of its un-contracted needs could be met via Australian supplies if the two countries can agree upon a favourable pricing terms,” he said.

Alongside the emergence of an increasingly loose spot market and ample opportunities for more efficient arbitrage, he said buyers would find it more attractive to sign short-term, smaller-volume deals with more flexible terms, rather than the traditional 20 to 25 year contracts.

LOWER