Egypt’s central bank Governor Tarek Amer is stepping up the war on the black market for dollars, seeking to build confidence in the Egyptian pound after the biggest devaluation since 2003.

Egypt’s economic recovery has been slowed by a foreign-currency shortage that has boosted black market demand for dollars. Authorities have said that narrowing the gap between the official and unregulated rates is essential to revive interest in Egypt’s debt and equity markets, deserted by foreign investors after the 2011 uprising against former President Hosni Mubarak.

Foreign holdings of Egyptian T-bills fell to less than $50mn in 2015 from more than $10bn almost five years ago.

“The central bank is playing a psychological war,” said Hany Farahat, senior economist at Cairo-based CI Capital Holding. “It is throwing liquidity in the face of the black market, making people trust that the central bank can deliver. This is the type of strategy needed for the black market to disappear.”

The central bank on Monday devalued the currency by 13% to 8.85 and said it would adopt a more flexible exchange rate to attract investments and shore up foreign reserves.

The devaluation was welcomed by the International Monetary Fund as well as investors, who sent Egyptian stocks up 8.8% over two days. Sovereign Eurobonds maturing in 2025 rallied again on Tuesday, with yields falling 18 basis points to 7.47%, for a 48-basis-points drop since the devaluation.

Egypt’s two biggest state-run banks, Banque Misr and the National Bank of Egypt, offered certificates of deposits paying 15% interest - on condition that clients exchange dollars to pounds to invest in them. Both said they would offer a call option to hedge the currency exposure of foreign investors seeking to invest in Egyptian Treasury bills.

“It seems like the central bank’s strategy is to remove the dollar shortage from the market, which is a welcome development,” said Anthony Simond, an investment manager who helps oversee about $10bn of emerging-market debt at London-based Aberdeen Asset Management.

The central bank didn’t say how it would finance the dollar sale. Given the absence of a recent announcement on large currency inflows, it is probably recycling money within the banking system, according to Omar El-Shenety, managing director at Cairo-based investment bank Multiples Group.

Authorities are encouraging dollar deposits, issuing certificates of deposit to collect more dollars, and then using them to fatten Egypt’s foreign-currency reserves or selling the currency to lenders, he said.

The central bank has kept the foreign currency reserves stable since September, partly by tapping into commercial bank deposits, according to Cairo-based Beltone Financial.

There will probably be more dollar injections this month as the central bank seeks to boost confidence and attract foreign portfolio investments, in so doing luring more trade from the black market, said Farahat at CI Capital.

“The million-dollar question becomes, ‘for how long can the Central Bank of Egypt continue to do that?”’ he said.

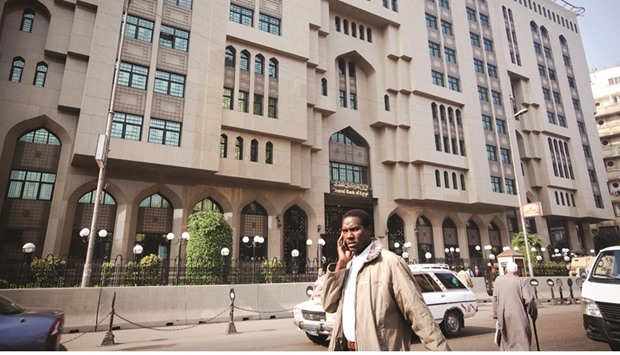

A pedestrian uses his mobile phone as he passes Egypt’s central bank in Cairo. Egypt’s economic recovery has been slowed by a foreign-currency shortage that has boosted black market demand for dollars.