Deutsche Boerse has agreed to acquire London Stock Exchange Group to create a giant in European trading, a deal that may kick off a bidding war as rivals look to scupper the agreement.

While the companies declared it a merger of equals, Deutsche Boerse stockholders will get 54.4% of the enlarged group in the all-share agreement, and German bourse Chief Executive Officer Carsten Kengeter will run the enlarged business. The board will be equally split between directors from LSE and Deutsche Boerse. LSE’s market capitalisation is $14.3bn.

The combined exchange operator would be the world’s biggest by revenue and the second largest by market value. It would be a powerful competitor to CME Group, Intercontinental Exchange and Hong Kong Exchanges & Clearing, although the transaction could yet be derailed by competition concerns.

It may also have to survive bids from other major exchange companies, such as Intercontinental Exchange, which has already said it is contemplating making a higher offer for LSE.

“It’s the right deal for the shareholders, customers and employees of both LSE Group and Deutsche Boerse,” LSE Group Chief Xavier Rolet said in a conference call. “It is absolutely the right time to take this transformational step in our histories.” Rolet will step down if the deal is completed.

The dealmakers, Kengeter and Rolet, share a Wall Street pedigree with stints at Goldman Sachs Group. Previous takeover attempts by the German exchange operator failed in 2000 and 2005.

The Anglo-German business would be a public limited company in London, with joint headquarters and listings in London and Frankfurt.

“They’re being very, very careful to position this as a merger and a merger of equals,” said Scott Moeller, a professor of corporate finance at London’s Cass Business School and a former investment banker. “It’s very close to being what a textbook merger of equals would look like.”

The combination would generate cost savings, or synergies, of €450mn ($499mn) every year after the deal is completed, the companies said in a statement yesterday.

Firms typically spend double their forecast annual savings from synergies in the first year or two of a deal, Cass data show. That means they have to find the cash to save money later on.

The new exchange operator will have a dominant position in Europe from which to expand into both Asia and the US It will be a powerhouse for clearing listed derivatives in Europe and over-the-counter contracts. The Euro Stoxx 50 Index, the FTSE 100 Index and the DAX Index will be under one roof.

The companies’ clearinghouses are central to the transaction. The institutions stand between buyers and sellers to reduce the damage caused if one of them defaults.

LSE and Deutsche Boerse’s clearinghouses will not be physically combined, Rolet said. Their regulatory oversight will also remain unchanged with the data centres and their management remaining separate.

Deutsche Boerse has a sizable futures-clearing business, while LSE is the majority owner of LCH.Clearnet, the world’s biggest clearer of swaps. Bringing the clearinghouses together would allow customers to reduce the overall collateral they hold at the two institutions, saving them money. The process is called cross-margining.

“If you combine them, then in a margining fashion, not in a legal fashion, by one becoming a member of the other and vice versa, then what you are able to do is you are able to reduce the margin for offsetting transactions,” Kengeter said.

Portfolio margining has become a focal point for banks since 2008. Regulations on both sides of the Atlantic have pushed more derivatives trades to clearinghouses.

The interconnections between banks during that crisis nearly took down the broader financial system. By putting a clearinghouse between the counterparties, the risk posed by a default becomes more transparent and more manageable.

Greater safety means greater cost for banks because clearinghouse members must provide collateral to back up their trades.

LCH is developing a portfolio-margining service called Spider to launch in the first half of the year. While LCH has its headquarters in London, the company also has clearing operations in the US, the eurozone and Asia. It held €56.9bn of cash collateral last year, a 21% increase from 2014.

The companies say the deal makes sense even if British voters opt to exit the European Union - a “Brexit” - in a referendum. A committee has been set up to advise on the ramifications of a “Brexit”, although the firms say the deal will proceed regardless of how Britons vote on June 23.

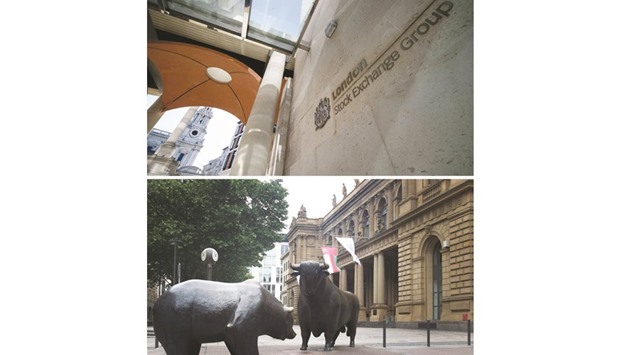

Combo of file pictures shows (top) the entrance to the London Stock Exchange and the bull and bear statue in front of the Deutsche Boerse (below). The LSE and the Deutsche Boerse yesterday agreed to press ahead with their planned merger to create one of the world’s biggest exchanges.