There are currently more than 120 project-financed schemes worth more than $110bn either planned or under construction in the GCC as governments increasingly seek alternative methods of financing their project plans in light of falling oil revenues.

According to data from regional projects tracking service, Meed Projects, the largest market for public projects backed with private sector finance is Kuwait, with just under $49bn of projects under its public-private-partnership (PPP) projects programme.

The state has been an innovator in advancing the PPP model in the region, with schemes ranging from power plants and water and wastewater facilities to schools and tourism projects falling under the programme, which is handled by the Kuwait Public Authority of Partnership Projects (KAPP).

The UAE is also a major player in privately-financed schemes, with about $35bn of projects planned or under way. These include Dewa’s Sheikh Mohamed bin Rashid Solar Park, the RTA’s Union Oasis real estate scheme, and Fewa’s Umm al-Quwain independent water project (IWP).

The four other GCC states have some $26bn worth of privately-financed projects between them, including the Facility D independent water and power project (IWPP) in Qatar, Riyadh’s King Khalid International Airport Expansion Terminal 5, and Oman’s Sohar IWP.

“The project finance model has been applied to power and water projects regularly over the past 15 years in the region, but it is only now with lower oil revenues that there is a concerted push to apply the model to projects in other sectors,” says Ed James, director (Content & Analysis) at Meed Projects.

“Governments are increasingly turning to innovative financing structures such as project bonds, sukuk issuances, and export credit agency financing to fund projects as revenues decline. By doing so, they can maintain spending on projects without impacting their balance sheets, a critical issue when state budgets are under strain from falling oil sales.”

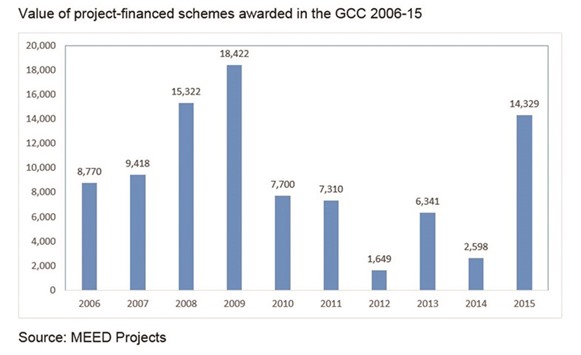

As the oil price fell in 2015, the value of project-financed schemes increased substantially to $14.3bn compared with just $2.6bn the previous year.

With the oil price showing little sign of rising in the short term, this number is expected to continue growing in 2016, Meed said.

..