Indonesia just made headlines in Islamic finance circles by setting up new rules that cover Shariah-compliant foreign exchange (forex) trading including hedging in the wake of rapid growth of Islamic foreign exchange transactions in the country and in an attempt to tackle the volatility of the national currency, the rupiah.

The new regulation has been a balancing act since forex trading is being looked suspiciously at by many Muslim scholars with regards to its permissibility as per Shariah rules. There is indeed a general consensus that different currencies can be exchanged on a spot basis, e.g. for example at a money changer in a foreign country or by wiring money to a foreign account and convert it at rates applicable at that time. This is halal because there is no interest or speculative risk involved, and the money changer or the bank can also charge a fee for their services.

But there are diametrically opposite views on the permissibility of currency exchange on a forward basis, that is, when the rights and obligations of both parties are to be exercised at a future date, which is the case with currency hedging as in foreign exchange forwards, futures contracts or currency swaps. This runs counter to the prohibition of riba, or interest, and qimar, which means speculation or gambling, because forward transactions are determined not just by the spot rate, but also by interest rates both currencies are exposed to. Additionally, such contracts also treat money as a “commodity” which is also against Shariah principles.

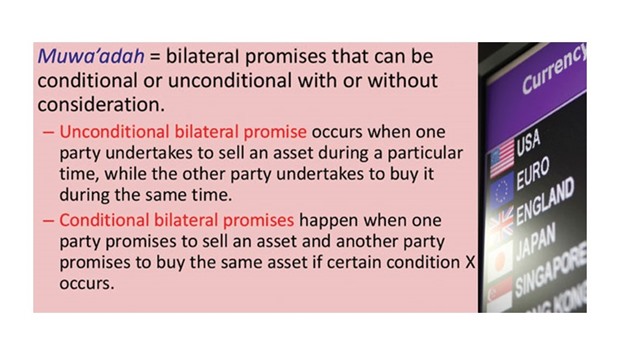

Indonesia is shipping around these problems by a regulation that requires a “non-speculative hedging agreement,” meaning that all hedging activities conducted by Islamic banks should have underlying assets. For this, the Indonesian National Shariah Board issued a fatwa saying that forward currency transactions are allowed under a scheme called “muwa’adah” which commits two parties to a future transaction at the spot rate and is basically a mutual promise wherein one party commits to buy an asset from the bank, while the bank commits to sell it to the client. Such promises can be conditional or unconditional. This form of remissible hedging is also confined to foreign exchange receivables and payables related to real goods and services only.

Edi Susianto, director for financial markets at Indonesia’s central bank, Bank Indonesia, said that the new regulation will bring an end to the limitations for the country’s Islamic banks in forex deals and the disadvantages occurring from them as compared to conventional banks. Those limitations are also perceived as one reason for the high volatility of the rupiah the country experienced in the past years.

“In a market situation where there is a low supply of foreign currencies, Islamic banks and their clients face a more volatile condition that creates losses if we cannot contain it,” Susianto said.

The new policy, in turn, would protect Islamic banks and their clients from the risk of future currency volatility in areas such as export and import financing, treasury activities and haj payments. It would also increase the confidence of foreign investors to invest in Indonesia, he added.

Indonesia since 2010 has seen a strong increase in forex transaction triggered by the growth of Islamic finance-based investments and widening trade finance portfolios, as well as an uptick in payments for the Haj pilgrimage to Makkah from the world’s most populous Muslim country. Forex transactions by Indonesia’s Islamic banks in 2010 stood at around $150mn, rising to $600mn in 2012 and over $1bn in 2014, central bank data shows. These transactions where directly exposed to the country’s sliding currency, making hedging inevitable in order to avoid huge losses for Islamic banks.

..