Egypt’s currency fell almost 15% versus the dollar yesterday after a long-awaited devaluation and Cairo stocks jumped 6%, while broader emerging stocks extended gains to hit three-month highs.

Egypt’s central bank said it was adopting a more flexible exchange rate policy, devaluing the pound to 8.85 per dollar in a move that follows the lifting of some currency restrictions last week.

The country’s stock market, which rallied 8% last week, extended gains for its biggest one-day move since last May.

The pound weakened 14.3% to the dollar to 8.95 but fell further in the non-deliverable forward (NDF) market, with three-month dollar/pound NDFs trading at 9.7.

“It’s clearly a positive step,” Jason Tuvey, a Middle East economist at Capital Economics, said, adding that the pound would need to fall further, to around 9.5 per dollar, to restore the economy’s competitiveness.

“Inevitably there will be short-term pain as inflation rises, and the central bank will hike rates at its meeting on Thursday, probably in the order of 100 basis points,” he said. “But in time the devaluation will bring benefits to Egypt...and encourage foreign investors back to the country.”

Broader emerging equities continued their rally driven by steadier commodity prices and developed central banks’ determination to keep the stimulus flowing.

Chinese regulators said they were in no hurry to withdraw funds used to shore up local stocks last year. That helped mainland shares end more than 1.5% higher. Hong Kong markets also ended higher after investors chose to focus on the bright spots in otherwise lacklustre economic data at the weekend.

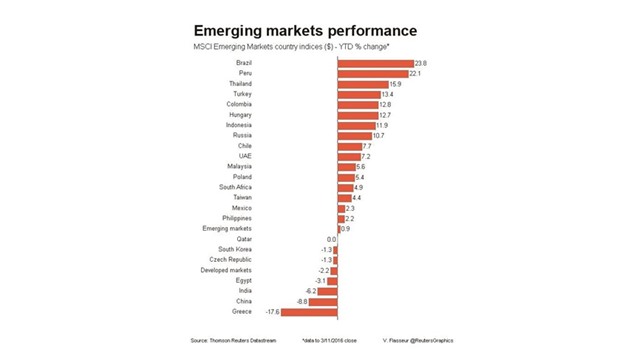

MSCI’s emerging equity benchmark rose 0.7%, bringing March gains to 9%, so far the best monthly performance since early-2012.

The best performer in emerging Europe was the Budapest index which rose 1.4% to fresh six-year highs on the promise of more rate cuts and government plans to support the exchange.

Other regional bourses also rose, thanks to Western European gains, eurozone stimulus and robust recent domestic data.

“The market is just extending the moves we saw prevailing last week which were in a positive direction,” said Cristian Maggio, emerging markets strategist at TD Securities. But he noted currencies were weaker as focus turned to potential risks from this week’s US Federal Reserve meeting.

Turkish markets showed little reaction to the weekend’s deadly bomb attack in Ankara, with the lira down half a per cent in line with most other emerging currencies and credit default swaps one basis point higher, according to Markit. Istanbul stocks were flat.

Brazilian CDS slipped one basis point to 386 bps, near four-month lows, Markit said, while the real firmed 0.2% to stay near six-month highs. Hopes of a change in government pushed Brazilian markets higher on Friday, ahead of weekend anti-government rallies that saw millions turn out across the country.

EMERGING