Chinese banks extended 726.6bn yuan ($111.80bn) in net new yuan loans in February, missing expectations and pulling back from a lending splurge in January, even as the central bank promised to keep policy loose to support the slowing economy.

The central bank is trying to keep liquidity flush to support the economy and cushion the pain from structural reforms, but officials have cautioned against excessive loosening that could increase downward pressure on the yuan.

Economists polled by Reuters had expected new loans to fall to 1.2tn yuan last month from January’s record of 2.51tn.

Some analysts believe the central bank has used its “window guidance” to try and slow the pace of banks’ lending. “The authorities put a brake on the credit growth, due to concerns over the overheating property market and rising CPI inflation,” said Zhou Hao, senior emerging markets economist at Commerzbank in Singapore.

“We believe that today’s number only reflects the administrative control measures, rather than any change in the monetary policy stance.”

Zhou expects credit growth to pick up in March, in line with rising mortgage loans and a further expansion in banks’ balance sheet as the government steps up fiscal spending.

The central bank said the broad M2 money supply measure (M2) grew at 13.3% from a year earlier, missing forecasts of 13.8% and outstanding yuan loans grew at 14.7% by month-end on an annual basis.

Analysts polled by Reuters had expected outstanding loans to rise by 15.2%, and predicted the money supply would rise by 13.8%.

The central bank aims for annual M2 growth of around 13% this year, pointing to further policy easing during a painful economic restructuring that could see millions of workers losing jobs.

Total social financing, another important indicator of China’s credit expansion, fell sharply to 780.2bn yuan in February from 3.42tn in January.

Chinese banks’ upstanding foreign-currency deposits rose to $655.2bn at the end of February from $646.9bn at the end of January, central bank data showed.

The People’s Bank of China (PBoC) cut bank reserve ratio requirements (RRR) on February 29 in its latest effort to boost growth, releasing an estimated $100bn of capital for lending.

Analysts expect the PBoC, which has cut interest rates six times since November 2014 and the RRR – the proportion of deposits that banks must park at the central bank as reserves – several times, to ease policy further in the coming months.

Commerzbank’s Zhou expected the PBoC to cut the RRR by another 100 to 150 basis points this year, and cut interest rates by 25 basis points.

The government has set a growth target of 6.5% to 7% for this year, as a spate of soft data points to further weakness at the start of the year and Beijing struggles to cushion the slowdown. The world’s second-largest economy grew 6.9% in 2015, its weakest pace in a quarter of a century, as activity was weighed down by sluggish demand, massive overcapacity in key industrial sectors, cooling investment and a weak property market.

Even with more rate cuts, economists see growth cooling further to 6.5% this year, and some market watchers believe real growth levels may already be much weaker.

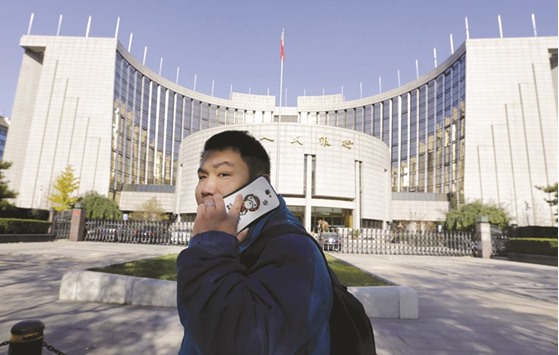

A man talks on his mobile phone while walking past the headquarters of the People’s Bank of China in Beijing. The PBoC is trying to keep liquidity flush to support the economy and cushion the pain from structural reforms, but officials have cautioned against excessive loosening that could increase downward pressure on yuan.