Egypt’s central bank kept the pound stable at 7.7301 pounds against the dollar at an exceptional auction yesterday for the sale of $500mn to cover imports of strategic goods, bankers said, pumping more foreign exchange into an economy that has been starved of dollars.

Egypt, which relies heavily on imports, hasn’t been able to recover since a popular uprising in 2011 toppled autocrat Hosni Mubarak, driving tourists and foreign investors away - major sources of hard currency.

Importers have been unable to obtain dollars, leaving many of their goods piled up at ports. Egypt relies heavily on imports of everything from food and medicine, to electronics and raw material for exports.

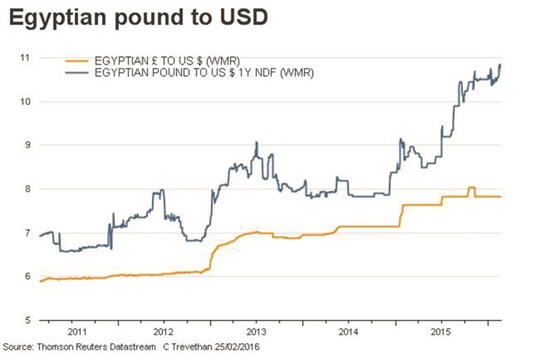

The central bank has been keeping the pound at 7.7301 per dollar, but the currency has been depreciating rapidly on the black market over the past week. It reached 9.50 to the dollar on the black market on Thursday.

“I think the sale could temporarily hold the decline (of the pound) for a couple of days but the investors and importers are looking for a more sustainable solution because the shortage situation has not been tackled,” said Hany Genena, head of equities at Beltone Financial. “It is just an auction to clear the backlog so the gap may stabilise temporarily,” he said.

The central bank normally sells no more than $40mn at its regular forex auctions, which are held three times a week.

A central bank official told Reuters earlier the purpose of the auction was to cover imports of strategic goods. The central bank announced the results of the auction, saying the cut-off price was 7.7301 pounds to the dollar but it did not say how much exactly was sold, apart from the auction announcement of $500mn earlier in the day.

Not all bankers received the full amounts that were requested, bankers told Reuters.

Egypt’s reserves have dropped from $36bn in 2011 to $16.53bn at the end of February.

A year ago, the central bank imposed strict controls on hard currency movements. These were eased this year but the currency shortage has made it harder for companies to operate and forced many to resort to the black market for their dollar needs.

..