Emerging stocks extended gains yesterday, heading for their biggest weekly rise in five months, while bonds also rallied, with Russian 10-year yields at 18-month lows on easing inflation expectations.

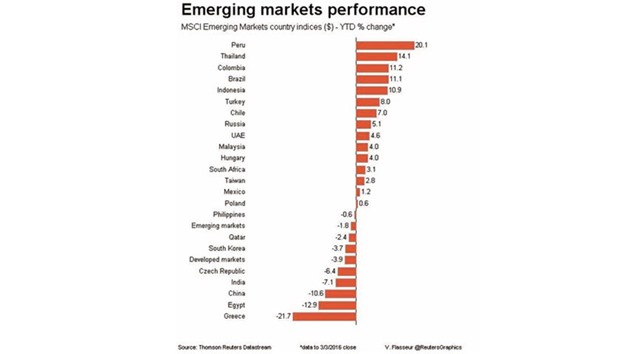

MSCI’s emerging equity benchmark was up 0.6%, rising for the sixth day in a row, thanks to a stabilisation in commodity prices and a growing conviction that the US Federal Reserve will not be in a hurry to raise interest rates.

Jobs data due later in the day are unlikely to change this view, especially after soft service sector employment data earlier this week.

Hong Kong shares rose to an eight-week closing high and mainland Chinese stocks closed half a per cent higher, with some speculation that government-backed investors had helped to stabilise markets before a key session of China’s parliament.

“This is just an extension of the bull move after the very bad start to the year,” said Cristian Maggio, a strategist at TD Securities, adding that even a bullish jobs figure was unlikely to significantly dent sentiment.

“What really matters to the market at the moment is what is implied by a potential Fed hike ... If the Fed hikes it’s because the economy in the US and therefore the global economy is not doing as badly as previously thought. That’s positive news for emerging markets,” Maggio added.

The dollar firmed slightly against a currency basket, dampening some EM currencies, although Asian currencies earlier in the day touched multi-week highs thanks to bond and equity inflows.

Emerging hard currency bond spreads versus Treasuries are at two-month lows while local currency debt average yields on the GBI-EM index are below 6.76%, their lowest since end-October 2015.

Russia has witnessed one of the biggest local debt rallies in recent days with its 10-year OFZ bond yield touching 18-month lows and this week’s bond sale three times oversubscribed.

The yield has fallen 100 basis points in the past month on expectations that oil price and currency stabilisation may allow the central bank to cut rates.

The central bank’s February poll showed Russians expected prices to rise by 9.2% over the next 12 months, down from expectations in January of a 9.8% rise. But the bank has played down this decline in inflationary expectations, analysts said.

“The conservative tone of the inflation rhetoric adds conviction to our view that the regulator is unlikely to cut its key rate (currently 11%) at its next few meetings. This could cool the prevailing rally in the OFZ market,” Moscow-based brokerage Aton told clients.

But the rise in oil prices did not appear to benefit Azerbaijan, which raised interest rates by 200 basis points to defend the manat and also sold $100mn from reserves . Brazilian assets were flat after sharp Thursday rallies spurred by the publication of allegations linking President Dilma Rouseff and predecessor Luiz Inacio Lula da Silva to a giant graft probe. This has raised hopes in Brazil for a change in political leadership.

..