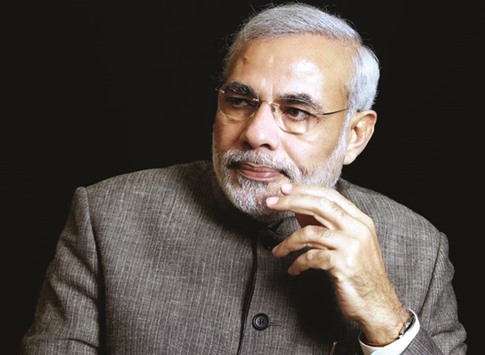

Prime Minister Narendra Modi’s message to Opec is come and store crude oil in India.

Modi’s February 29 budget exempts foreign companies from federal income taxes on permitted local sales of oil kept in caverns India has been building. That may spur the Organisation of the Petroleum Exporting Countries to fill the bunkers, allowing Modi to skirt the full cost of about $5bn for stockpiling a targeted 130mn barrels.

“This is a good way to fill up the caverns,” said Arun Kumar Sharma, finance director at the country’s biggest refiner Indian Oil Corp. “Most of our refineries are heavily dependent on Opec crude.” Using India’s bunkers would help the bloc maintain its 85% share of the local market. A portion of the oil would likely be ring-fenced for use in a crisis, with the rest available to trade. The world’s third-largest crude buyer is seeking to boost small strategic reserves of just 10mn barrels. India’s emergency stockpile is a fraction of the supply buffers in neighbours Japan and China, even in a world awash with cheap crude looking for a home.

“The Indian model is similar to the Japanese model, in that the country saves money by allowing other nations to store crude but has first access to it in the case of an emergency,” said Amrita Sen, chief oil market analyst at Energy Aspects in London.

India could boost the strategic reserve by 30mn barrels this year, but there may be delays to the schedule of having the rest in place by 2020, Sen added. The government is seeking to create strategic storage capacity of 17.83mn tonnes across seven caverns, which would provide cover for 40 days. Some 1.33mn tonnes in one cavern is in place now, and two others with a total 4mn tonnes capacity are due to be completed by May.

Besides emergency tanks, refiners have capacity to store as much as 28.5mn tonnes of crude and fuels in tanks and pipelines, sufficient for 63 days. Several national oil companies from Opec members in the Middle East are interested in storing crude in Indian caverns, people familiar with the matter said in 2015. Last month, Oil Minister Dharmendra Pradhan said Abu Dhabi National Oil Co has offered to store oil at the Mangalore emergency reserve in southern Karnataka state. An official said two-thirds of the deposit would be strategic storage and the rest can be traded.

Brent crude, the global benchmark, has slipped about 40% in the past year and was trading at $36.76 a barrel at 3:18 pm Singapore time yesterday.

“Persistent weak oil prices have made storage plays more attractive for oil producers,” said Abhishek Kumar, senior energy and modeling analyst at Interfax Energy’s Global Gas Analytics in London. “Land-based oil storage is still cheaper than floating storage, which is prompting some producers to utilise spare storage capacity in countries such as India and China.” While India is moving to make sales of crude from bunkers free of federal income tax, the nation’s states impose other levies foreign companies would have to pay. “The budget proposal is a step in the right direction,” said Tushar Tarun Bansal, a senior oil consultant at analyst Facts Global Energy in Singapore. “However, overseas investors and producers would want complete clarity on all the various taxes and duties that may potentially be applicable before deciding.”

Modi: Seeking to create strategic storage capacity of 17.83mn tonnes across seven caverns.