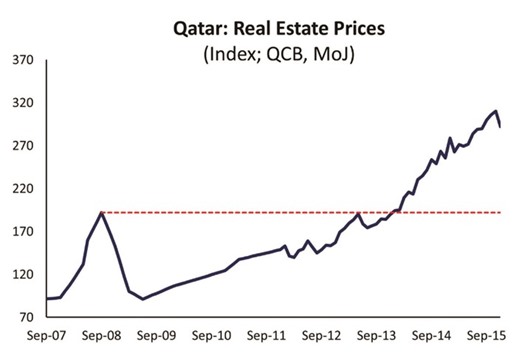

The long rally in Qatar real estate prices looks drawing to an end as “growth prospects weaken”, according to Samba Financial Group.

This is despite the continued investment momentum from the FIFA 2022 World Cup preparations and sustained population growth, Samba said in its latest ‘GCC Chart Book’.

In Dubai also, Samba said real estate prices remain on the retreat, and are likely to stay weak as new supply come on stream. Although, the lifting of sanctions on Iran may provide some support from that source, it said.

In view of the low oil price, Samba said the GCC producers will need to adjust to a major oil price shock.

After years of large surpluses, this oil price shock has pushed GCC fiscal accounts into deficit. These are around 15% of GDP for Saudi, Bahrain and Oman, and are projected to worsen in 2016.

“Hopes for an improvement hinge on both a recovery in oil prices as well as sustained efforts at fiscal consolidation,” Samba said.

Public spending has already been reined in and further cuts are in prospect over 2016. In addition, all GCC states have moved to reform their energy and utilities subsidies, and are preparing to introduce VAT by 2018. Generous welfare systems are likely to be rolled back and Saudi Arabia is also looking to privatise state assets and intensify diversification efforts. Generally, low public debt levels leave plenty of scope for new debt issuance to help fund fiscal deficits, although governments will also look to draw on their own savings.

Last year saw a surge in GCC bond and sukuk issuance. However, this largely reflected the resumption of domestic government bond issuance in Saudi Arabia for the first time since 2007. GCC corporates were less active, although banks continued to raise funds in capital markets.

Saudi Arabia issued $30bn in domestic bonds in 2015, and is looking to issue a similar amount this year, augmented by its first international sovereign bond issuance. GCC sovereign issuance in general is expected to rise this year, and banks may also be pushed to raise more funds.

All GCC central banks except Qatar and Oman have followed the US Fed in raising policy rates 25 bps. In contrast, Qatar is expected to lower its repo rate from 4.5% to 2.5% to help banks dealing with strained liquidity conditions, Samba said.

Reflecting both an increase in policy rates as well as tightening liquidity as oil revenues decline, GCC interbank rates have surged, it said.

..