Nakilat will “exploit future opportunities to acquire new business opportunities,” serving the international marine sector, and to increase the utilisation rate for the shipyard facilities at Erhama Bin Jaber Al Jalahma Shipyard.

An indication of these developments was the signed memorandum of understanding (MoU) with Qatar Development Bank (QDB) agreeing to collaborate in areas including marine export, credit insurance and financing, Nakilat said yesterday.

“This ultimately assists small to medium enterprises in entering the maritime industry by working together in order to provide services for Nakilat,” the company said.

In addition to its shipping business, the company is also a key player in sustainability. Nakilat’s continuous attention to safety, health and environment (SHE) elements and quality systems was demonstrated by the seamless transfer of four LNG and four LPG vessels into ship management under Nakilat Shipping Qatar Limited (NSQL), a wholly-owned subsidiary of Nakilat. This was the result of a detailed and in-depth management of change that was successfully achieved.

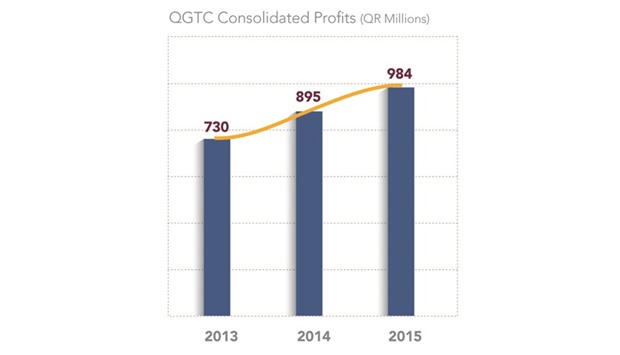

Meanwhile, Nakilat has posted a net profit of QR984mn in 2015, up 10% on the previous year.

Nakilat’s operations “have achieved higher profitability by growing business streams” through the addition of three new LNG vessels to its LNG Fleet during 2015, full operation of vessels acquired during 2014, optimisation of operating expenses and leveraging lower finance costs.

The company’s board of directors recommended distributing shareholders’ a cash dividend of 12.5% of the nominal value of its capital, which translates into QR1.25 a share. It was also decided to invite the ordinary general assembly to convene on March 7.

The board commended the company’s strong financial results, which it said “clearly reflect the strength and stability of the company’s commercial position. This improvement was primarily driven by the company’s tactical strategy on capitalising profitable business consolidations and risk assessment management which reinforces Nakilat’s position as a global leader in the LNG transporting industry.”

The board stated that Nakilat was in a “favourable” position due to the “stable” cash flows and “highly rated” sponsors incorporated with “long-term and positive” contract structures. Similarly, rating agencies had noted last year that the company’s success was attributed to its resilience to market volatility and its experience in ship management with a consistent and reliable record for operating LNG ships.

Even in the midst of the “unstable” oil and gas sector, Nakilat has “continually performed well” whilst being minimally impacted over the oil price fluctuations.

The Board of Directors has affirmed Nakilat’s commitment to pursue aggressive developments and growth strategies in the long term, in order to achieve strong returns to its shareholders.

Business / Eco./Bus. News

Nakilat to ‘exploit’ future opportunities to acquire new business ventures

NAKILAT