The value of deals at Asia’s biggest airshow fell sharply as mammoth plane orders of the past thinned due to airline overcapacity and a global economic slowdown, organisers and analysts said yesterday.

Despite growth in Asia’s passenger air traffic, seats remain in surplus with regional carriers continuing to take delivery of planes they had ordered during the past few years, analysts said, as the show’s trade portion wrapped up in Singapore. It opens to the public at the weekend.

Airshow organisers said 10 deals announced at the biennial event had a total value of $12.3bn, well below the record $32bn reached in 2014.

However, there were 40 deals whose values were not disclosed, organisers added.

In the 2012 airshow, transactions totalled $31bn, a threefold increase over 2010.

“This airshow has been the most quiet and most muted in terms of sales and buzz,” said Shukor Yusof, founder of Malaysia-based aviation consultancy Endau Analytics.

“There are far too many aircraft orders already from the region, so we are seeing airlines do the sensible thing and not getting carried away by placing more orders,” he told AFP.

Because of the overcapacity, airlines are slashing ticket prices to keep market share, putting downward pressure on yields, Shukor said.

“There are indications that while passenger traffic remains very robust, airlines are not extracting the gains that they should be because there are far too many seats available,” he said.

The International Monetary Fund and World Bank have slashed their outlook for global economic growth, notably in China, where the economy is slowing down and the stock market has recently taken a beating.

“Looking at the next 18-24 months, it doesn’t look very positive in terms of the global financial sector and the economy,” Shukor said.

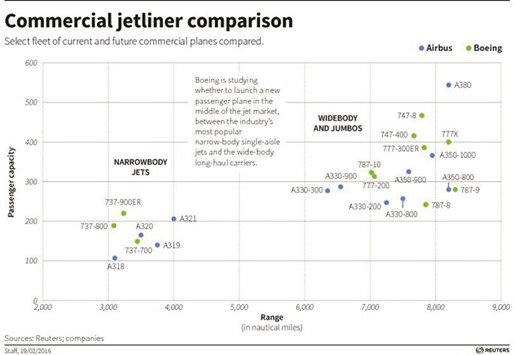

The biggest deal announced at the show was a $3.04bn order from Vietnamese budget carrier VietJet Air for Pratt & Whitney engines to power the 63 Airbus A320neo and A321neo aircraft it has purchased. Philippine Airlines, flag-carrier of one of Asia’s fastest growing economies, ordered six A350-900s from Airbus in a deal worth $1.85bn. Chinese carrier Okay Airways committed to buy 12 aircraft from US-based Boeing for $1.3bn.

Japan’s Mitsubishi Aircraft Corp won 20 orders from a US leasing company for its new regional passenger plane, a transaction potentially worth around $940mn. The deal for the MRJ90 jets – Japan’s first domestically-made commercial aircraft for about half a century – is a major boost for Mitsubishi after postponed delivery of the plane in December, a little more than a month after the maiden test flight.

Yesterday, Boeing said it had won a $440mn contract with Papua New Guinea’s flag carrier, Air Niugini, for four 737 MAX 8 planes. Rajiv Biswas, chief Asia-Pacific economist at IHS, said despite the lack of big-ticket purchases, aircraft manufacturers still “have a long pipeline of aircraft deliveries to absorb over the next four years” because of previous large orders.

..