Southeast Asia requires 3,750 new aircraft worth $550bn in 20 years from 2015, a senior Boeing executive told a press conference ahead of the Singapore Airshow that starts today.

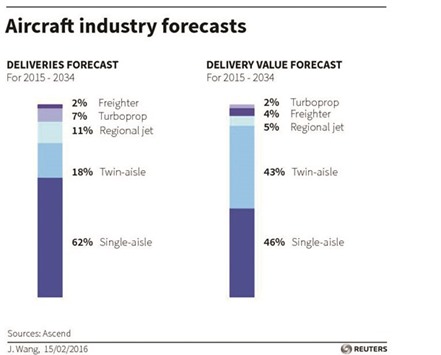

Of this, 76% will be for single-aisle aircraft like the Boeing 737 and Airbus A320, said Dinesh Keskar, senior vice-president for Asia Pacific and India sales at Boeing.

This will be largely driven by low-cost carriers, and the growth of markets such as Indonesia, Myanmar and Vietnam, he added.

Southeast Asian passenger traffic has grown by more than 9% since 2010, with intra-Southeast Asian traffic projected to increase by 7.7% over the next 20 years, said Keskar.

“The total pie and the number of people travelling is still very low,” he added.

The Asia Pacific region as a whole will absorb 14,550 aircraft, more than a third of the 39,050 aircraft that are required globally, according to Boeing’s forecast.

IATA director general Tony Tyler said on Sunday that record plane orders placed by ambitious Southeast Asian airlines could be at risk in an environment of intense competition, low profitability and turmoil in financial markets.

Fast growing low-cost carriers such as Indonesia’s Lion Air, Malaysia’s AirAsia and India’s IndiGo have ordered hundreds of Airbus and Boeing jets over the last decade in a bid to secure market share.

Lion is the only Boeing customer of those three, and Keskar said that the airline had been taking all of its ordered 737s. Boeing, he added, was in a “good spot” and had not had requests for deferrals from any of its other customers.

“Most of our customers have been ordering 25, 30, 40 aircraft at a time and then replacing them every three to four years,” said Keskar, who added that the steady growth plans help these airlines.

Meanwhile, Malaysia Airlines (MAS) has delayed plans to sell some of its Airbus A380 jumbo jets, and will now keep all six of them at least until 2018 after retiring its fleet of Boeing 777s, its chief executive told Reuters yesterday. The Kuala Lumpur-based carrier has tried to unsuccessfully sell the planes for the last year to cut costs as part of a restructuring plan which also saw it withdraw from several long-haul European routes.

After accelerating the retirement of its much older Boeing 777-200 fleet, the airline has decided to keep the A380s in service until it gets the first of its new Airbus A350 widebody jets, Christoph Mueller said ahead of the Singapore Airshow. “We need them for the long haul market,” said Mueller of the A380s, which the airline flies only to London.

“We are still evaluating what we want to do with the A380. We have six and we will keep them at least until 2018, when we get the first A350,” he added.

MAS is also evaluating if it needs two more A350s to add to the four that it will get from leasing companies, Mueller said, adding that these planes will serve medium-haul, intra-Asia Pacific routes that the airline will focus on as part of its post-restructuring strategy.

Mueller, an experienced industry executive, was hired to push through the restructuring at MAS in May 2015 after Malaysian national investment firm Khazanah took it private.

MAS suffered a massive blow to its brand after flight MH370, which was carrying 239 passengers and crew, disappeared in March 2014. In July 2014, another flight, MH17, was shot down over eastern Ukraine, killing all 298 people aboard.

Mueller said the airline still aimed to return to profit by 2018. “We are not profitable yet but we are getting there,” he added. “The markets are soft now, and that’s not just China. All segments are affected. But we can overcome that.”

As part of its restructuring, the airline has suspended non-stop services to Amsterdam, Paris and Dubai, and is using a new codeshare partnership with Dubai-based Emirates Airline to connect its passengers to destinations in Europe, Africa and the US. Mueller said MAS hoped to extend this codeshare to “all points” on the airlines’ combined networks to “give us many points in, for example Africa and Europe, that we can’t fly to but where there is demand”.

One challenge to the restructuring programme has been the depreciation of the ringgit against the US dollar, with many costs such as fuel prices and aircraft lease pegged to the dollar, Mueller said.

In a bid to increase revenue to offset higher costs, the airline is looking at ways to attract more passengers and upgrade its in-flight offerings, such as rolling out a new business class product this year and possibly adding in-flight mobile and Internet connectivity.

..