Turkey’s central bank may be running out of wiggle room to avoid an interest-rate increase.

While Governor Erdem Basci hasn’t raised borrowing costs for more than two years, annual inflation is climbing back toward 10% and economists predict the lira will approach record lows as early as next month. The scope to raise banks’ funding costs is diminishing at the same time that the lowest level of foreign-exchange reserves since 2012 restricts policymakers’ ability to prop up the currency.

All these factors are pointing in one direction. Turkey will need higher borrowing costs to ring-fence the lira. And that would run counter to calls by President Recep Tayyip Erdogan and others to cut rates in an effort to spur economic growth.

“The central bank’s foreign-exchange ammunition is limited and it’s not willing to tighten monetary policy,” said Ozgur Altug, the chief economist at BGC Partners in Istanbul. “This leaves the lira more vulnerable to external shocks.”

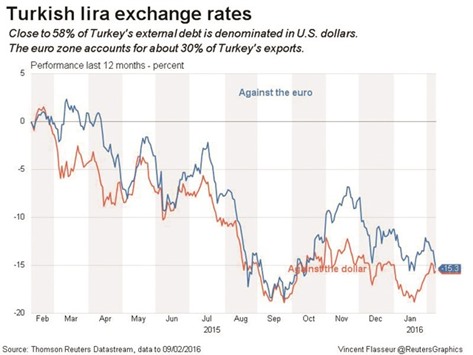

According to forecasts compiled by Bloomberg, Basci will raise the key one-week repurchase rate to almost 9% by year-end from 7.5% now. Turkish lenders are already paying more than that to access central-bank cash, yet the tighter funding conditions haven’t stopped the lira from depreciating 15% over the past year to 2.9247 per dollar by 2.19pm in Istanbul yesterday.

Policy makers are scheduled to meet next on February 23.

The currency will weaken to 3.10 per dollar in the second quarter, surpassing the previous trough of 3.0752 breached in September, according to the median forecast compiled by Bloomberg.

Dollar-lira swaps are already at the top end of the central bank’s corridor, which is comprised of three different rates. Efforts to raise the average cost at which it lends to banks has had little impact on market rates because policy makers are “behind the curve,” Altug said. After two years of declines, Turkey’s gross reserves, which include gold, stand at $111.3bn. On a net basis, reserves are the lowest since 2007.

..