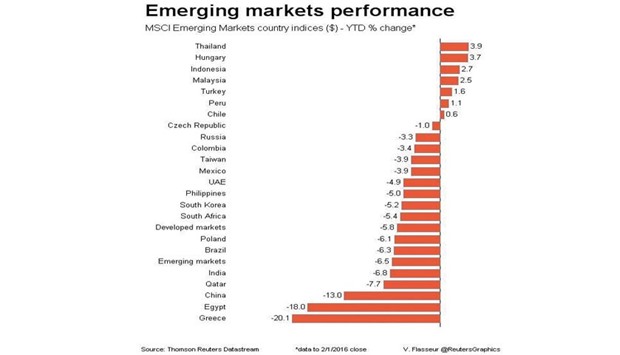

MSCI’s emerging market index fell 1.3% with bourses across much of Asia, Russia and eastern Europe chalking up losses as oil prices fell for a second straight day towards $33 a barrel.

An expected decision by the Reserve Bank of India (RBI) to keep rates unchanged before the government presents the new budget at the end of February added to the sombre mood, analysts said.

“You still have this broad risk aversion. People were hoping that if the RBI wanted to be overly dovish, that would be a sign you would get a bit more support from central banks,” said Rich Kelly, head of global strategy at TD Securities.

“It’s reasonable of them to stay on hold, especially with the budget on tap, but we’re still in an environment where the market wants to be consoled a bit and it just didn’t get that.”

Dollar-denominated stocks in Moscow lost 3.7%, while the bourse in Johannesburg tumbled 1.8% and Warsaw-listed equities fell 1.4%.

Bourses across Asia also traded broadly lower.

Yet mainland Chinese stocks finished the day more than 2% higher in thin trading and the country’s central bank guided the yuan to its highest daily fix in almost a month as Beijing sought to keep markets calm heading into the Lunar New Year holidays.

Currencies also came under pressure. Russia’s rouble slipped 2.6% against the dollar to trade at its weakest in a week while in Kazakhstan the tenge tumbled 3.5%.

South Africa’s rand fell 1% while Turkey’s lira weakened 0.4%.

While eastern European currencies had started the day on a strong note with the Polish zloty hitting initially an 18-day high, they gave up much of their gains as crude oil prices slipped deeper into the red.

The zloty was flat while Hungary’s forint weakened by 0.4%.