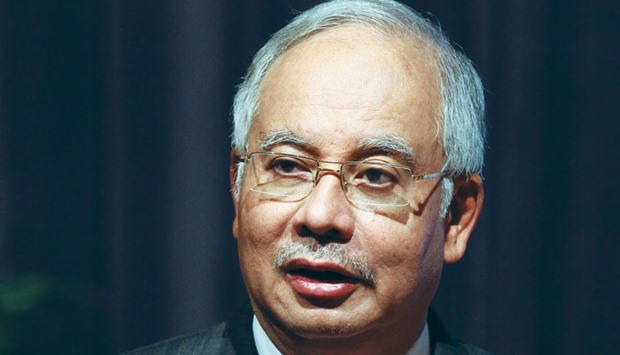

Najib aims to cut the deficit to 3.1% of gross domestic product this year, from about 3.2% in 2015, and balance the shortfall by 2020. He’s in the midst of a 10-year development plan to achieve advanced economy status.

Malaysian Prime Minister Najib Razak’s goal of reining in the budget deficit looks set to get tougher as a unit of the nation’s biggest lender predicts borrowing costs on Islamic bonds will climb to a record.

Maybank Islamic Asset Management says benchmark sukuk yields may rise to 5% this year should the US raise interest rates to 1.25% from a maximum 0.5% now, and if investors price in further tightening in the following 12 months. That paints a bleak picture for companies in the world’s top Shariah-compliant debt market after contending with a slide in the ringgit last year that made it Asia’s worst performer.

Higher yields on government debt may complicate Najib’s efforts to fund a $444bn development programme to build railways, roads and power plants. The ringgit is already down 2.2% in 2016 as a sell-off in Chinese stocks sparked risk aversion, driving the yield on 10-year Islamic notes to the widest relative to shorter maturities since 2010.

“Yields for Malaysian sukuk are still going to be volatile,” said Syhiful Zamri Abdul Azid, the Kuala Lumpur-based chief investment officer at Maybank Islamic, who helps oversee 17bn ringgit ($3.9bn). We will “cut holdings of Malaysian government sukuk and top-rated corporate debt should US interest rates rise significantly by 1% or more,” he said.

The Southeast Asian nation’s 10-year Shariah-compliant debt yield climbed 25 basis points to 4.52% in 2015 and touched an unprecedented 4.56% on December 14, according to a Bank Negara Malaysia index. It was two basis points off that high last Wednesday. The yield’s rise will be capped around 4.7% if the US benchmark rate doesn’t reach 1.25%, Syhiful said.

The difference in yield between the securities and two-year notes increased to a high of 128 basis points last Wednesday. Najib aims to cut the deficit to 3.1% of gross domestic product this year, from about 3.2% in 2015, and balance the shortfall by 2020. He’s in the midst of a 10-year development plan to achieve advanced economy status.

The outlook for higher borrowing costs hurt Malaysia’s Islamic bond sales in 2015, with issuance falling 15% to 55.1mn ringgit, the least in four years, data compiled by Bloomberg show. While CIMB Group Holdings Bhd and AmInvestment Bank Bhd predict a revival in 2016, RHB Investment Bank Bhd sees offerings ending up similar to last year.

“Malaysia’s 10-year sukuk yield is expected to remain largely unchanged at 4.60% as lower supply of that maturity and an accommodative monetary policy will offset further increases in the Fed’s rate,” said Angus Salim Amran, the Kuala Lumpur-based head of financial markets at RHB Investment Bank, the country’s second-biggest Islamic bond arranger.

The Fed raised its key rate in December for the first time in almost a decade and Angus predicts it will increase to 1% in 2016, with hikes in the second and fourth quarters.

Local yields have been more affected by what the US will do than on Malaysia’s policy direction. The central bank has kept its overnight rate at 3.25% since July 2014 as the ringgit slid 19% last year, the biggest decline since 1997. Current central bank governor Zeti Akhtar Aziz is also due to retire in April, clouding the policy outlook.

“While most market players agree that the direction of the Fed’s rate is on the way up, albeit at a slower pace than anticipated earlier, the direction for the overnight policy rate is far less certain,” said Johar Amat, head of Treasury at OCBC Al-Amin Bank Bhd, the Shariah-compliant unit of Singapore’s second-biggest lender. “The market is also anxiously waiting for the announcement of who the next governor will be and the opportunity to gauge his or her hawkishness.