Iran is talking with European and Asian refiners about new oil contracts as Tehran readies old clients for its return to the market when sanctions are lifted.

“We have been in negotiations with European refiners with positive results,” Seyed Mohsen Ghamsari, head of international affairs at National Iranian Oil Co, said in a phone interview yesterday. “Some of these European refiners have told us they would like to go back to their old, pre-sanctions contracts and we have told them we have no reservations about activating their old contracts.”

Iran offered Indian refiners additional oil for an upcoming term contract, though no amounts have yet been decided, said two people with knowledge of the talks who asked not to be identified because the matter is private. Refineries in Europe have also held talks on renewing term contracts, three other people said, with the first crude delivery possible in the first quarter.

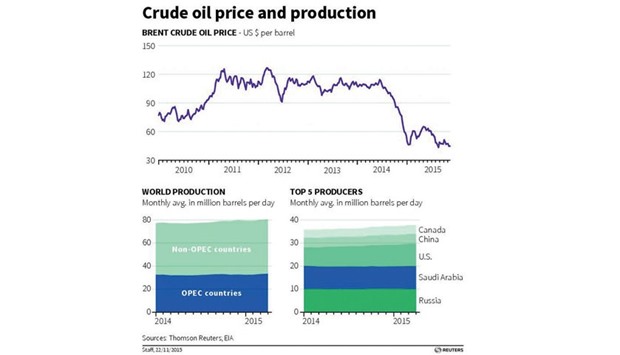

Europe and Asia are set to become targets for Iranian crude as the impending lifting of sanctions imposed in 2012 over Tehran’s nuclear programme triggers a fight to regain markets lost to exporters including Saudi Arabia, Russia and Iraq. While Iran has continued shipping about 1mn bpd to six nations, including India, the halt in sales to Europe makes the region a key objective.

“It’s not going to be easy for Iran to regain its market share,” Eugene Lindell, an analyst at JBC Energy GmbH in Vienna, said by phone. “While the flows to Asia have been reduced, they haven’t been reduced to the same extent as they were in Europe. That’s probably where they’re going to be marketing their crude most strongly.”

Iran is trying to regain its lost share of global crude sales and plans to increase exports by 1mn bpd in two phases once sanctions are lifted, Oil Minister Bijan Namdar Zanganeh said on January 3, according to the official Islamic Republic News Agency.

Iran has previously offered bigger discounts to European than Asian customers, showing the importance it attaches to this market, according to Lindell. “It’s perfectly logical that there will be term talks at the earliest possible opportunity,” Lindell said.

Oil exporters can sell crude via spot contracts that involve delivery on a cargo-by-cargo basis or via term contracts, which tend to be agreed to for six months to a year.

One European oil trader who has spoken with the Iranians said they had not yet offered term contracts even though the country has said it’s keen to do business with them. The oil glut that has sent prices to a 12-year low is likely to remain unresolved with the return of Iranian barrels this year. Tehran has repeatedly said it plans to add 500,000 barrels in oil exports within a week of the removal of international sanctions before adding the same amount within six months.

Saudi Arabia, the biggest producer in the Organisation of Petroleum Exporting Countries and Iran’s rival in the battle for influence in the Middle East, has anticipated the return of Iranian crude by offering bigger discounts in Europe. Riyadh increased the discount on the light grade it sells to the Mediterranean for next month by 20 cents from January.

Iran exported about 585,000 bpd of oil to Europe in 2011, the year before sanctions were imposed, with Italy, Spain and Greece being its main destinations, according to the International Energy Agency. That same year, its total production averaged 3.6mn bpd, and has since dropped by a quarter to 2.8mn last month, according to data compiled by Bloomberg.

Imports of Iranian crude averaged about 995,000 barrels of oil in November, according to the latest IEA report, with China, India, Turkey, Japan, Syria and South Korea being the main buyers.

Crude