Emerging market assets remained under pressure in the final days of 2015 with stocks extending losses yesterday as Saudi Arabia’s budget announcement weighed heavily on its bourse while many currencies also weakened.

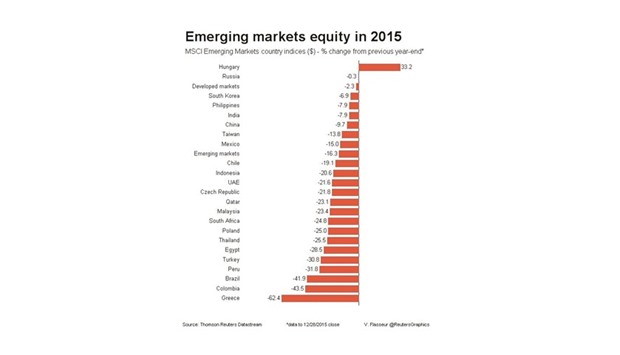

MSCI’s broadest emerging market index slipped 0.2% in its second straight day in the red and is on track for an annual loss of more than 16% though trading remained thin in many markets.

Gulf markets racked up some of the steepest losses on the day despite oil prices stabilising.

Saudi Arabia’s bourse tumbled more than 3% in early trading after the government announced its 2016 budget late on Monday which included spending cuts, rises in fuel prices, reforms to energy subsidies and a drive to raise revenues from taxes and privatisation.

“The 2016 budget ... marked the biggest shake-up in economic policy for over a decade and suggests that the government is not counting on a major recovery of oil prices any time soon,” BNY Mellon analysts wrote in a research note.

The move weighed on other stock markets in the region, with bourses in Kuwait slipping some 0.8%.

However, Russian rouble stocks traded higher, while indexes in mainland China ended the day firmer after the central bank vowed to maintain reasonable credit growth and keep the yuan stable.

China’s yuan briefly touched a 4-1/2 year low due to strong year-end dollar demand before recovering again while Russia’s rouble weakened 0.5% against the dollar, its fourth straight session in the red.

“In recent days we have been seeing pretty big moves again in the rouble to new record lows as we move to year end,” said Nomura’s Tim Ash, adding this was partially due to the rouble catching up with the decline in oil prices.

“But I think it is also recognition by Moscow that 2016 could actually be a much more difficult year for the Russian economy than had hitherto been assumed.”

In fellow oil producer Kazakhstan, the tenge stumbled almost 2% lower against the dollar in a third day of losses.

Across central and eastern Europe, the Romanian leu hit its weakest level in nearly two years against the euro due to year-end import transactions while the forint also weakened, resuming last week’s slide following gains on Monday.

EM ASSETS