Oil demand is expected to grow firmly in Qatar in 2016 with transportation fuels, especially gasoline, and industrial fuels such as diesel and residual fuel oil playing a "significant part" in the overall oil demand growth, an Opec report has shown.

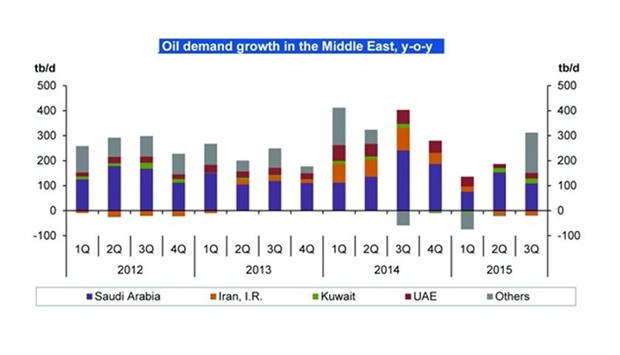

Oil demand growth in the region is projected to reach 0.19mn bpd in 2015, while in 2016 it is anticipated to record around 0.21mn barrels per day of growth.

Oil demand grew strongly in Qatar and the UAE this year, shows Opec’s latest ‘Monthly oil market report’. In both countries, transportation fuels – notably gasoline – dominated the increases.

Elsewhere in the Middle East, solid demand requirements have been registered in October with oil demand growth in Saudi Arabia hitting the highest level in 2015.

Oil demand in Saudi Arabia continues its positive momentum, growing by around 0.34mn bpd, or 15% year-on-year. All products recorded positive gains during the month, without exception.

Direct crude burning recorded highest gains in both percentage and volumetric basis, it said. Transportation, industrial fuels and direct crude burning were the contributing elements in rising Saudi Arabian demand in 2015, which continues to be the pattern of consumption during October this year.

Demand grew solidly also in Kuwait, particularly lifting road transportation and industrial fuels, gasoline and gas diesel oil. Iraqi oil demand continued its positive growth trend which started in June, with most gains being observed in fuel oil and gasoline.

But, the report said Middle East oil demand growth may be challenged in 2016 by some downside risks, which relate to the continuing geopolitical turbulence in some countries.

The report also showed world oil demand in 2015 was estimated to grow by 1.53mn bpd, around 300,000 bpd higher than the initial forecast in July 2014.

The upward revision has been supported by lower oil prices in the main demand centres, particularly the Organisation for Economic Co-operation and Development (OECD), Americas and Europe.

Motor fuel consumption in the US and Europe was encouraged by cheaper product prices, along with improving car sales. Petrochemical consumption also contributed to the higher growth.

In the non-OECD, demand growth came mainly from China, India and the Middle East. In contrast, Brazilian oil requirements slipped back into a contraction as economic momentum slowed.

In 2016, world oil demand is expected to grow by 1.25mn bpd, partly supported by the improvement in global economic activities. The OECD region is anticipated to rise by 150,000 bpd, led solely by the US, while Europe and Asia Pacific are seen declining.

In the non-OECD region, growth is expected to be around 1.1mn bpd, with China showing slightly lower growth.

Steady oil requirements are expected in Asia, the Middle East and Latin America.

Nevertheless, the demand forecast for 2016 is subject to considerable uncertainties, depending on the pace of economic growth, development of oil prices, and weather conditions, as well as the impact of substitution and energy policy changes.

Non-Opec supply growth in 2015 has been revised down by 310,000 bpd since the initial forecast to now stand at 1mn bpd. This has been mainly due to the impact of low oil prices and declining investments in the oil industry.

The adjustment is also attributable to downward revisions in both the OECD and developing countries of 420,000 bpd and 40,000 bpd, respectively.

Higher-than-expected growth in the UK, Malaysia, Russia, China and Colombia has been more than offset by lower-than-expected growth in Canada due to the wildfire in Alberta in Q2, 2015, the unexpectedly sharp decline in Mexico, and higher declines in Australia and from Caspian producers.

US oil output increased by a lower-than-anticipated 810,000 bpd, the report said.

In 2016, non-Opec oil supply is forecast to decline by 380,000 bpd. Growth is seen coming mainly from Canada and Brazil, with declines also expected in the US, Mexico, Russia, Kazakhstan, the UK and Azerbaijan.

Opec’s natural gas liquids (NGLs) are seen increasing by 170,000 bpd in 2016, following a growth of 160,000 bpd in 2015.

As a result of the current forecasts, the demand for Opec crude in 2016 is expected at 30.8mn bpd, which represents an increase of 1.5mn bpd over the estimated level for 2015.

Business / Eco./Bus. News

Qatar 2016 oil demand to firm up on transportation, industrial demand: Opec

Oil demand growth in the Middle East is projected to reach 0.19mn bpd in 2015, while in 2016 it is anticipated to record around 0.21mn bpd of growth.