Reuters

London

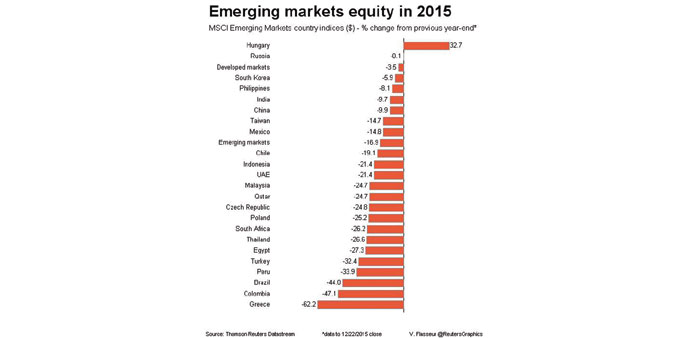

Emerging market stocks saw their sixth rise in seven days yesterday as investors looked for some last minute bargains in an area that has lost almost 17% this year.

With trading volumes minimal ahead of festive holidays it was impossible to say how long the mini-revival would last, though there was a general sense among EM followers that 2016 is unlikely to be as difficult as 2015 has been.

MSCI’s closely-followed 23-country index topped the 800 point level as it rose 0.8%, but the day’s big focus was on Brazil, one of the heavyweights that have been hardest hit during this year’s turmoil.

Its central bank is due to publish a new inflation report later which is likely to signal whether it will have to hike interest rates next month in an already beleaguered economy.

The real was hovering just off a record low hit in September. It has lost over 30% since the start of the year as a recession has been exacerbated by a series of scandals that has engulfed President Dilma Rousseff.

“We expect the central bank to increase expected inflation for 2016 and 2017 and that is probably going to have immediate implications for its January meeting,” said Cristian Maggio, head of emerging markets strategy at TD Securities.

“If the real gets any weaker between now and the meeting, it would definitely increases the chances of a hike,” he added, saying it could be between 50 and 75 basis points. Elsewhere, Turkey’s lira steadied at 2.9268 having taken a 1% tumble on Tuesday after the country’s central bank opted not to raise interest rates despite inflation running at over 8%.

President Tayyip Erdogan has repeatedly called for lower interest rates to boost economic growth, fuelling fears of political interference in central bank policy.

Istanbul stocks rose 1.3% to take their gains over the last seven sessions to over 7%.

A small tick-up in oil prices from 11-year lows and a softer dollar were helping some of the big commodity producers.

A rise in its government bond yields pushed South Africa’s rand lower though Russia’s rouble rose 0.7% as traders shrugged off the US adding another 34 Russian individuals and firms to its sanctions list.

Overnight in Asia, the majority of the regional stock markets had climbed and currencies were mostly flat to firmer.

China’s central bank, which has a history of making changes around this time of year, said it would extend the yuan’s trading hours on the Shanghai-based foreign exchange market from January 4.

The move will allow trading in the Chinese forex market to overlap with European trading hours and is Beijing’s latest effort to internationalise its increasingly influential currency.