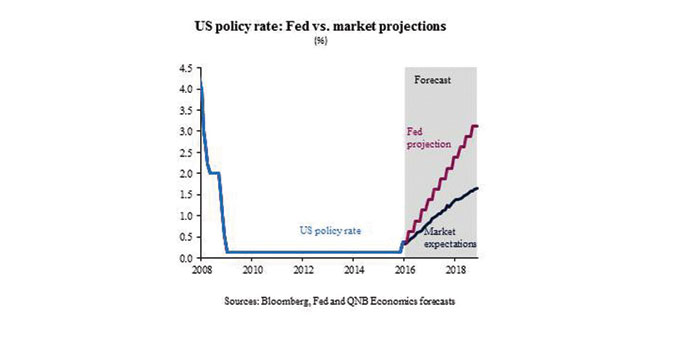

After seven years of near-zero interest rates, the US Federal Reserve (Fed) has decided to raise rates by 25 basis points. The event was long-awaited and largely expected by financial markets, which seem to have taken the increase in their stride. But we have long argued that the future path of interest rates is more important than individual rate hikes. And on this, the Fed and financial markets have different views. The Fed foresees the speed of interest rate increases to be four hikes per year, while financial markets expect a slower tightening cycle at the rate of two hikes per year. How these two differing views eventually converge will matter a great deal for the global economy and financial markets.

Why did the Fed raise interest rates? The main reason is the improvement in the labour market, indicated by an unemployment rate of 5%, close to where the Fed estimates equilibrium unemployment to be (4.9%).

The rapid fall in unemployment since it peaked at 10% in October 2009 convinced the Fed that it was appropriate to act despite subdued inflation (0.2% year-on-year in October). The Fed expects headline inflation to rise as the effect of low oil prices drops out of the year-on-year calculations.

More importantly, the Fed believes that the tight labour market will eventually lift inflation through higher wages. And while wage growth has picked up in recent months, confirming the Fed’s theory, it is too early to judge whether this is a persistent trend or merely short-term noise.

The fact that the US has managed to exit the era of zero interest rates is credit to the Fed, which expertly managed monetary policy in the aftermath of the financial crisis in 2008 using both conventional and unconventional tools. In the depth of the crisis, many — influenced by the experience of Japan — thought that once a country enters the state of zero interest rates, it gets stuck there forever. Some countries (such as the Euro area and Sweden) did increase interest rates post-2008, only to realise that this was a policy mistake, reversing their decision and ending up with lower and even negative interest rates. And while the Fed’s decision now looks appropriate, one can envisage two scenarios in which the Fed rate hike may turn out to be a mistake with the benefit of hindsight.

The first scenario is that the rate increase will directly lead to a derailing of the recovery in the US economy. Higher interest rates will increase borrowing costs for investment and will make saving more attractive relative to consumption. Both could lead to weaker domestic demand.

In addition, higher interest rates could increase the value of the US dollar, hurting exports. While the Fed acknowledges these risks, it believes in the underlying strength of the US economy, given the healthy state of private consumption and the recovery in the housing market. In any case, we have to wait for incoming data to see if this scenario actually occurs.

The second scenario is that the Fed rate hike will result in a violent reaction in financial markets. This could lead to capital flight (especially from emerging markets), tighter global monetary policy, weaker global growth, which could spill over to the US economy through trade and financial linkages. This scenario could unfold as the Fed increases interest rates at a faster rate than markets expect. There is a risk that the second scenario may actually materialise for two reasons.

First, in the previous three US tightening cycles, markets underestimated the speed at which the Fed tightened interest rates. They could repeat that this time around.

Second, there is already a gap between the Fed’s forecasts for its interest rate path and markets expectations. The Fed expects to normalise interest rates at a speed of four 25 basis point increases each year, but financial markets are only pricing in two per year (see chart). This creates space for potential corrections in financial markets.

So far, the reaction from financial markets has been muted. The first rate hike was largely priced in by market participants, and financial markets seemed to have taken it in their stride. But the issue of how the diverging views between the Fed and financial markets is eventually resolved could become the focus of market observers going forward.

Now that the question of when the Fed was going to raise rates has been finally resolved, the next question is how fast.