Reforms needed to avoid rising unemployment, deficits and debt; Investments would double GDP, create 6mn jobs by 2030

Bloomberg

Dubai

Saudi Arabia can’t afford to wait for oil prices to recover and needs to accelerate economic measures to avoid rising unemployment, deficits and debt, McKinsey & Co Inc has said in a report.

The country requires public and private investments of as much as $4tn as part of a strategy to boost productivity and create jobs, the report said. Based on current trends, Saudi Arabia “could face a rapid economic deterioration over the next 15 years.” Even a public spending freeze and halt to hiring foreign workers would still leave the country facing falling household incomes, rising unemployment and weakening finances.

“This is a call to dramatically accelerate reforms which ultimately will provide a more sustainable future,” Jonathan Woetzel, a McKinsey Global Institute director and main author of the report said by phone. “Waiting for the world to get better is not an option.”

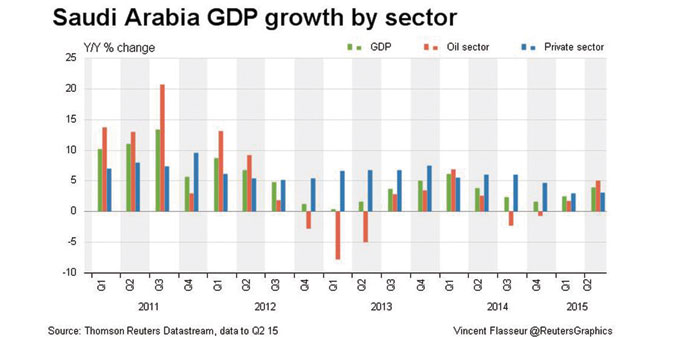

A slump in crude prices, the government’s main source of revenue, is pushing the world’s biggest oil exporter into its first deficit since 2009 and its foreign reserves to a three year low. The International Monetary Fund predicts that Saudi’s savings, $640bn at the end of October, would run out after five-years under current spending policies. In response, the government is planning to cut spending on infrastructure projects, and tapping debt markets to fund the deficit.

The bulk of the $4tn in investments needed would come from the private sector and should focus on mining and metals, petrochemicals, manufacturing, retail, tourism, healthcare, finance and construction, according to McKinsey. If this level of investment were achieved the country could double the size of its economy and create 6mn new jobs by 2030.

Failure to make progress on productivity-boosting measures would lead to the government’s finances “deteriorating sharply,” according to the report. Reserves would drop and public debt could reach as much as 140% of GDP.

“Even freezing spending would still mean burning through its reserves at a rapid pace and lead to the a decline in average incomes,” Woetzel said.

Saudi Arabia’s cabinet last month approved a landmark tax on undeveloped urban land to encourage the development of empty real estate and address a housing shortage.