Reuters

Cairo

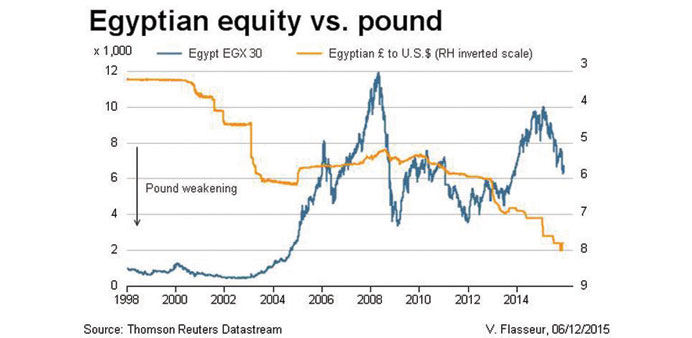

The Egyptian pound held steady at an official foreign currency auction yesterday and strengthened slightly on the black market Egypt, which depends on imported food and energy, is facing a dollar shortage and mounting pressure to devalue the pound. The central bank surprised markets when it strengthened the pound on November 11 by 20 piasters against the dollar.

On Thursday, it sold 39.5mn dollars at a cut-off price of 7.7301 pounds to the dollar, unchanged from Thursday, with a pro-rata of 33.33%.

The official rate is still far from the black market, which was around 8.52 pounds to the dollar yesterday, making the pound marginally stronger than Thursday’s rate of 8.53 pounds, one trader said.

Egypt’s reserves have tumbled from $36bn in 2011 to $16.4bn in October, and the country has been rationing dollars through weekly dollar auctions to banks, keeping the pound artificially strong.

On Tuesday, the central bank said it had changed the way it allocated dollars at its foreign exchange auctions. It provided fewer banks with dollars but at higher allocations.

Previously, banks in Egypt had been accustomed to receiving a regular quota of dollars at each foreign currency sale. Since the changes, some banks said they were declined dollars at the regular auctions.

The country has been starved of foreign currency since a popular uprising in 2011 ousted autocrat Hosni Mubarak and drove tourists and foreign investors away.

In February, the central bank imposed capital controls, limiting dollar-denominated deposits to $50,000 a month in an attempt to fight the black market. The move caused problems for importers, who could no longer source their foreign currency needs.