Reuters

London

Emerging stocks fell to 2-1/2-week lows yesterday while most currencies slipped on disappointment over the European Central Bank’s stimulus package, although central European assets retraced some of the previous day’s sharp losses.

Investors rushed to unwind hefty short euro positions after the European Central Bank on Thursday unveiled a bare-minimum easing package, cutting deposit rates by just 10 basis points and extending asset purchases by six months.

The euro’s biggest rally in seven years took a toll on investors who had sold the currency to buy emerging assets.

“Some of the consensus positions in recent weeks have been the euro as a funding currency of choice but yesterday’s move indicated that the ECB may be coming to an end of the line with easing measures and that this is not a one-sided trade by any means,” said Peter Kinsella, head of EM research at Commerzbank.

“That illustrates that euro-funded EM carry trades won’t function well.”

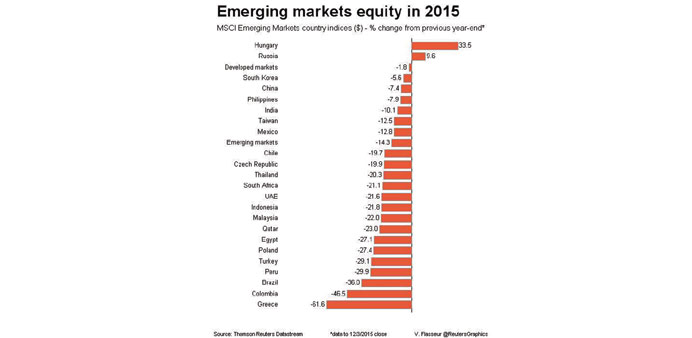

MSCI’s benchmark emerging equity index was down 0.84%, putting it on course for a second weekly loss, tracking a move lower on global markets. Chinese stocks fell almost 2% and Hong Kong and South Korean shares were almost 1% lower.

South African stocks slipped 1.6%, dragged lower by a fall of more than 3% in MTN after Nigeria backtracked on the size of the reduction in a fine it has levied on the telecoms operator.

In emerging Europe, Polish stocks fell 1.4% to new 6-1/2 year lows and were on track for their biggest weekly loss in more than two years. Turkish stocks were down 1.26% to two-month lows.

The Polish zloty and the Hungarian forint clawed back some ground against the euro after losing more than 1% on Thursday, but the zloty remained near an 11-month low.

The lira and South African rand lost 0.3% as the dollar strengthened.

Kinsella said that as a result of diminished appetite for euro carry trades and a strong dollar, there would be “more gradual weakness in emerging currencies, but no capitulation” given the huge falls earlier this year.

The rouble was marginally positive, though it remains on track for a weekly loss of 1.7%. Oil prices edged higher ahead of an Opec meeting, and Moody’s raised the outlook on Russia’s credit rating to stable from negative.

The ratings agency said there was a diminished likelihood of the Russian economy facing a further intense shock in the next 12-18 months..

Another big emerging economy, South Africa, faces ratings reviews from Fitch and Standard & Poor’s. Fitch is expected to cut its “BBB” rating by one notch.

Investor focus is now on US non-farm payrolls jobs data due later on Friday. A solid reading will cement expectations of an interest rate hike by the Federal Reserve in less than two weeks, adding to dollar strength.

Earlier, the Malaysian ringgit firmed to a six-week high against the dollar after a sharp rebound in exports.

Brazilian offshore-listed assets stayed firm, with the ADR of state oil firm Petrobras marked up 1.6% in Frankfurt, adding to gains made after parliament started proceedings to impeach President Dilma Rousseff.