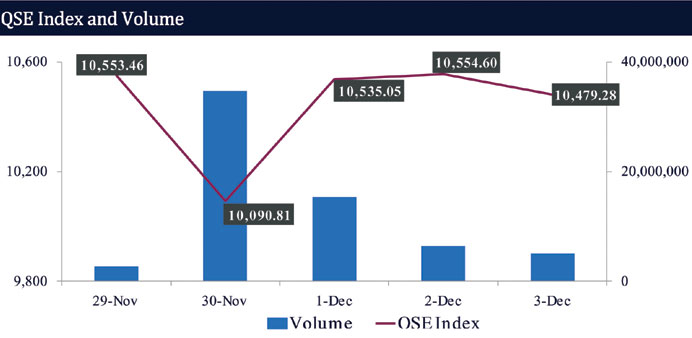

The Qatar Stock Exchange (QSE) index lost 42.93 points or 0.41% during the week to close at 10,479.28, QNB Financial Services (QNBFS) said in its weekly market report.

Market capitalisation decreased by 0.42% to QR550.6bn compared with QR552.9bn at the end of the previous week, QNBFS said.

Of the 43 listed companies, 10 companies ended the week higher, while 30 fell and three remained unchanged. Gulf International Services (GISS) was the best performing stock for the week with a gain of 3.1% on 9.8mn shares traded. On the other hand, Al Meera Consumer Goods Company (MERS) was the “worst” performing stock with a decline of 7.8% on 49,784 shares traded.

Ezdan Holding Group (ERES), Nakilat (QGTS) and Commercial Bank (CBQK) were the primary contributors to the weekly index loss. ERES was the biggest contributor to the Index’s weekly loss, shedding off 40.3 points from the index.

QGTS was the second biggest contributor, erasing 14.8 points from the index. CBQK pushed the index down by 12.1 points.

On the other hand, Industries Qatar (IQCD) added 25 points to the Index, while Qatar Insurance Company (QATI) contributed 14.8 points to the index.

Trading value during the week increased by 163.3% to reach QR2.5bn compared with QR954.8mn in the prior week.

The industrials sector led the trading value during the week, accounting for 31.4% of the total trading value.

The banks and financial services sector was the second biggest contributor to the overall trading value, accounting for 27.9% of the total trading value.

QGTS was the top value traded stock during the week with total traded value of QR597.8mn.

Trading volume increased by 184.6% to reach 64mn shares compared with 22.5mn shares in the prior week. The number of transactions rose by 53.4% to reach 25,849 transactions compared with 16,854 transactions in the prior week. The transportation sector led the trading volume, accounting for 38.9%, followed by the industrials sector, which accounted for 20.5% of the overall trading volume.

QGTS was also the top volume traded stock during the week with total traded volume of 24.6mn shares.

Foreign institutions remained bearish during the week with net selling of QR275.8mn compared with selling of QR115.9mn in the prior week.

Qatari institutions remained bullish with net buying of QR236.1mn compared with a net buying of QR7.4mn the week before. Foreign retail investors turned bearish for the week with net selling of QR7.5mn as opposed to net buying of QR16.9mn in the prior week.

Qatari retail investors remained bullish with net buying of QR47.0mn compared with net buying of QR91.7mn the week before.

Year-to-date in 2015, foreign institutions bought (on a net basis) $572mn worth of Qatari equities, QNBFS said.