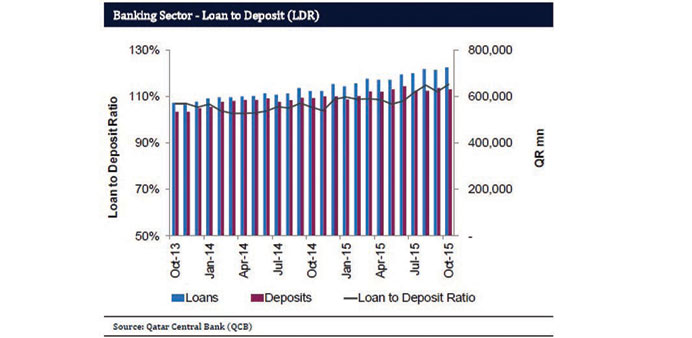

Qatar’s banking sector witnessed loan-deposit ratio increase to 115% in October against 112% in the previous month; even as the Qatar Central Bank is aiming to limit the ratio to 100% by the end of 2015.

The increase in loan-deposit ratio in October has been on account of higher public sector credit off-take and lower public sector deposits, QNB Financial Services said in its latest banking sector update.

Public sector’s total credit registered a growth of 2.2% month-on-month (MoM), while its deposits shrank 3.8%, leading to an increased loan-deposit ratio, it said.

Qatar’s banking sector saw 1.9% MoM expansion in loan book, mainly led by exposure to the public sector, according to QNBFS.

The loan book was up 11.1% year-to-date (YTD) after declining by 0.7% MoM in September 2015, QNBFS said.

Total domestic public sector loans increased 2.2% MoM (down 2% YTD) against a decline of 3.7% MoM in September 2015.

The government segment’s loan book grew 7.8% MoM (1.1% YTD) compared with a decline of 12.7% in September, QNBFS said, adding the government institutions segment (representing about 60% of public sector loans) continued to display flat performance MoM during September and October (down 2.6% YTD).

On the other hand, the semi-government institutions segment receded 1.1% MoM (down 6.6% YTD). Hence, the government sub-segment pulled the overall loan book up for the month of October 2015.

Private sector loans inched up 0.6% MoM (16.7% YTD) against 0.8% MoM in September 2015. The real estate segment followed by services positively contributed toward the loan growth.

The realty segment (contributing about 28% to private sector loans) increased 1.1% MoM (21.9% YTD); while services was up 0.7% MoM (10.5% YTD).

Moreover, general trade and contractors segments increased 0.8% MoM (13.6% YTD) and 0.7% MoM (25.7% YTD), respectively.

On the other hand, consumption and others (contributing about 29% to private sector loans) treaded a flat path in October (14.9% YTD).

The banking sector witnessed 1% MoM fall in deposits (4.8% YTD) in October 2015. Public sector deposits dropped 3.8% MoM in October 2015 compared with an expansion of 5.7% MoM in September. The government institutions’ segment (constituting about 54% of public sector deposits vs 57% at the end of 2014) declined 7.5% MoM (down 12.9% YTD).

Moreover, the semi-government institutions’ deposits receded 2.4% MoM (down 8.9% YTD) after gaining 7.6% MoM in September (increasing 4.2% in August 2015).

On the other hand, the government segment posted decent performance, climbing up 2.8% MoM (2.2% YTD).

On the private sector front, the companies and institutions’ segment deposits gained 1.6% MoM (22.6% YTD). However, the consumer segment deposit was down 0.9% MoM (down 9.4% YTD). Non-resident deposits exhibited flat performance MoM (55.2% YTD).