By Arno Maierbrugger

Gulf Times Correspondent

Bangkok

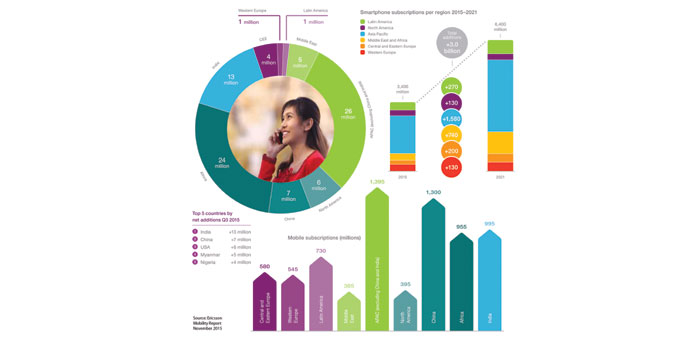

Myanmar, a country served by Qatar’s telecom giant Ooredoo, is the fourth-fastest growing mobile phone market in the world, contributing around 6% to the 87mn people who become new mobile subscribers in the third quarter of 2015 all over the globe.

Myanmar ranked fourth in net additions this quarter, trailing only giant neighbours India and China – which added 13mn subscribers and 7mn customers, respectively – and the US whose base increased by 6mn. However, Myanmar beat Nigeria despite its huge population of 174mn people, which rounded out the top five and whose market expanded by 4mn net subscribers this quarter.

The figures were the result of the new Ericsson Mobility Report for the third quarter of 2015 released last week.

The report says that currently, there are almost as many mobile subscriptions as people in the world (around 7.3bn), and every second, 20 new mobile broadband subscriptions are activated. In addition to the increase in subscribers, data consumption also continues to rise.

Consequently, mobile data traffic in the third quarter of 2015 was 65% higher than in the third quarter of 2014, largely driven by increased video consumption on mobile devices.

“Almost 70% of all mobile data traffic will be from video by 2021,” says Rima Qureshi, senior vice president and chief strategy officer of Sweden’s Ericsson Group.

The lion’s share of global subscriptions with 3.69bn can currently be found in Asia-Pacific, including China and India, followed by Africa and Latin America. Asia-Pacific will also grow most in absolute terms over Ericsson’s forecast period. In terms of expected relative growth, the Middle East and Africa will lead the pack.

Smartphone subscriptions in this region are forecast to grow more than 200% between 2015 and 2021, and overall mobile subscriptions are expected to increase by 35% in the period, more than in any other global region.

“Several countries in the Asia-Pacific region will experience a strong subscription uptake over the next five years, while more mature regions like North America and Europe will have more moderate growth,” Qureshi says, adding that ”growth is expected to be particularly strong in the Middle East and Africa due to a young and growing population and rising GDP. Also, subscriber penetration in this region is low compared to the rest of the world.”

Myanmar is a particular good example of a market taking up mobile services that were previously unavailable for all but a few. Mobile subscription as a whole, whether through smartphone or not, stood at 9% in 2012 and have reached 54.6% by mid-2015. The forecast is a penetration of over 70% by 2018.

Smartphone subscriptions penetration in Myanmar, from a level close to zero only a few years ago, is currently around 30% and is expected to more than double by 2018.

Most people in Myanmar, as in many developing markets, make their first experience with the Internet on a smartphone, usually due to limited access to fixed broadband.

Such an experience usually leads to exponential growth as peer groups and grass root businesses quickly start to utilise the new communication technology.

Globally, it took over five years to reach the first billion smartphone subscriptions, a milestone that was passed in 2012. But after that, it took less than two years to reach the second billion. The 4bn mark is expected to be reached by 2016.