Given Singapore’s track record in tackling “Third World” problems over the last 50 years, the City State can hopefully solve the “First World” problems it is facing today, QNB has said in a report.

This year was a landmark year for Singapore. The country celebrated 50 years since its independence in 1965. It also witnessed the death of its founding father and long-serving prime minister (from 1959 to 1990), Lee Kuan Yew.

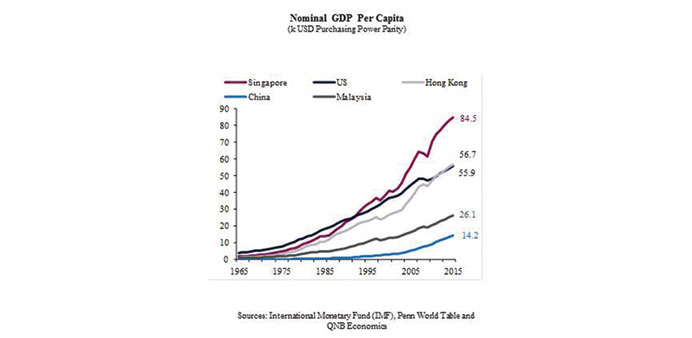

Singapore had a remarkable journey over the last 50 years; a journey that transformed it into one of the richest countries in the world.

“But today it faces different challenges to those encountered after independence,” QNB noted. These challenges include an ageing population, slow productivity growth and exposure to a weakening global economy through trade and finance. The nature of these challenges is indicative of Singapore’s journey from Third World to First.

Singapore has come a long way since independence in 1965, when it separated from a short-lived federation with Malaysia.

Back then, the City State served as a channel for global trade with its two big neighbours (Malaysia and Indonesia). It had no natural resources and at least three quarters of its population had no primary education.

Unemployment was high at 14% with British military bases employing 16% of the population and accounting for nearly a fifth of GDP.

Today, Singapore’s economy is “one of the most dynamic” in the world. The country acts as a global hub for manufacturing, trade and finance. Its labour force is highly educated, unemployment is low at 2% and its people are the third richest in the world (after Qatar and Luxembourg) with GDP per capita at $84,5000.

On how Singapore managed to achieve this transformation, QNB said economies generally grew by either expanding factors of production (labour, capital and land) or by improving productivity.

“Singapore did both,” it said. Since 1965, its land area increased by 20% through land reclamation projects. Population increased from 2mn to 5.5mn, mainly through immigration. Capital stock increased rapidly with large investment spending financed by mandatory domestic savings and a flood of foreign direct investments.

Productivity was boosted by training and education of the population and importing foreign know-how. Foreign companies were attracted to Singapore’s robust legal and regulatory structure, clean and efficient government, fiscal incentives, excellent living conditions and business-friendly environment.

Despite its remarkable journey, Singapore today faces a number of structural challenges, which also confront other advanced economies like Japan and the Euro area. The growth of its labour force has fallen with the ageing population. The share of 65 year olds or above has almost doubled since 1990.

This challenge could be solved by continuing to accept working-age immigrants, but there are moves to reduce reliance on foreign workers and increase nationalisation ratios. Restructuring initiatives, which began in 2010, aim to fill the growth gap by raising productivity per worker through training and education. But these types of initiatives take time before they bear fruit.

As a result, potential growth of the economy (the growth rate of the labour force plus productivity growth), which describes the supply capacity of the economy, has declined from 6-7% before 2010 to an estimated 3.2%.

In addition to the demographic challenge, Singapore also faces external and domestic cyclical headwinds. On the external side, slow global growth has impacted Singapore. The IMF expects the world economy to experience the weakest expansion for six years in 2015.

Given the size of Singapore’s economy and its extreme openness (trade is about four times the size of GDP, the highest share in the world), this has negatively impacted Singapore. On the domestic side, the slowdown in credit growth and the decline in house prices have hurt domestic consumption and investment. As a result, QNB expects real GDP growth to fall to 2.2% in 2015 from 2.9% in 2014.

“Despite the headwinds, there is a lot to be positive about. Singapore’s government and policymaking are efficient.

Fiscal policy remains supportive and monetary policy was eased twice this year in response to the headwinds. The authorities are successfully tackling the housing boom and have engineered an orderly soft landing of house prices rather than an outright bust, which would have hurt households and financial institutions,” QNB said.

Business / Business

Singapore with strong track record capable of meeting its current economic challenges: QNB