Reuters

London

Emerging stocks extended gains yesterday and were set for their biggest weekly rise in more than a month though weaker oil prices forced a pause in Russia’s roaring rally and saw bets rise against the Saudi riyal.

Emerging markets (EM) have benefited from the conviction that US interest rates will rise very gradually. Many also see many emerging assets as cheap enough to warrant interest and China unlikely to descend into crisis.

Citi strategist Luis Costa noted that short-dated US yields had already repriced significantly, with 2-year yields up more than 30 basis points in the past month. Fed officials have also been hammering home the gradual rate rise message.

“This is making markets comfortable, if US short-term rates don’t sell off further we could see more retracement (in EM assets),” Costa said. “But there will be pockets of weakness; the price action is ignoring what’s happening in commodities.”

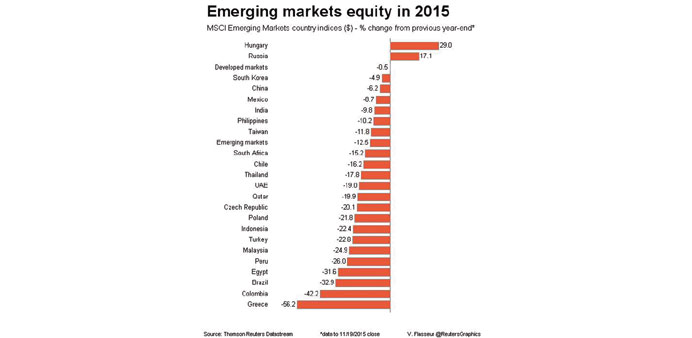

MSCI’s EM equity index touched two-week highs, up 2.5% this week. Most currencies too will end the week with gains, with China’s yuan edging up on suspected dollar sales by state-run banks.

That stabilisation effort came a day after Reuters reported the yuan could enter the International Monetary Fund’s currency basket at a lower weighting than expected.

But inclusion will be hugely positive for China, with BNP Paribas calculating that in six years, the yuan could comprise 4.7-6.7% of global reserves, implying up to $110bn worth of annual yuan buying.

Elsewhere, commodity prices weighed. As oil inched lower, Russian stocks retreated from nine-month highs, hit this week on hopes that rapproachement with the West over Syria could lead to the rollback of sanctions.

The rouble fell 0.7% against the dollar but is up 3% this week but Russian local OFZ bonds extended gains, with 10-year yields at new one-year lows. Costa said he recently took profit on OFZ trade but will use market pullbacks to build up positions.

“Some months ago with this level of oil prices, yields would have been higher,” he said. “Russia’s macro looks ... stable in the short-term with potential for disinflation which makes people keen to play fixed income.”

There were new signs of stress in Saudi Arabia where one-year dollar/riyal forwards rose back to 12-year highs as investors hedged against the risk of riyal devaluation.

The riyal is pegged to the dollar around 3.75 and authorities have pledged to hold the peg. They have enough reserves to do so but low oil prices and fiscal deficits may put pressure on that promise.

“External speculative pressure on the peg is mounting and this cannot be ignored,” Scotiabank analysts told clients. “The recent surge in dollar/riyal forwards suggests a rise in concern about the peg and future path of the riyal.”