By Pratap John/Chief Business Reporter

Qatar and other countries in the Middle East that maintain a currency peg to the dollar may be impacted when the US Federal Reserve raises interest rates, says a new report.

Qatar and six other Middle Eastern countries maintain a currency peg to the dollar. They are: Bahrain, Oman, Saudi Arabia, the UAE, Jordan and Lebanon.

Kuwait’s currency is pegged to a basket that includes the dollar.

As such, when the Fed raises interest rates, most likely by early 2016, an impact on countries across the Middle East can be expected, said the Institute of Chartered Accountants in England and Wales (ICAEW) in its ‘economic insight’ jointly produced with Cebr.

However, due to the unique nature of the region, these countries, which are dubbed ‘GCC+5’ will not be impacted by a US rate rise in the same way as is expected in many of the world’s emerging markets such as Brazil and Indonesia, it said.

“Since the US lowered its interest rates to almost zero seven years ago, emerging markets have relied on cheap financing options to fuel economic growth. An increase in the US interest rates would make it more desirable for investors to hold the dollar.

“This could render emerging economies vulnerable to capital flight as investors rush to acquire US dollars, leading to depreciation in emerging economy currencies and unfavourable shifts in the terms of trade (ratio of export prices to import prices). Furthermore, companies in these emerging economies that have taken on dollar-denominated debt could face difficulties servicing the debt after local currency depreciation,” the report noted.

“But a lot of these factors do not apply to all countries in the Middle East,” ICAEW said.

The GCC countries, for example, benefit from large sovereign wealth funds and trade surpluses, both of which minimise their dependence on external financing and are therefore, better able to withstand monetary policy tightening in the US.

“Nonetheless, the region will be impacted by US rate rises in a different way,” ICAEW points out.

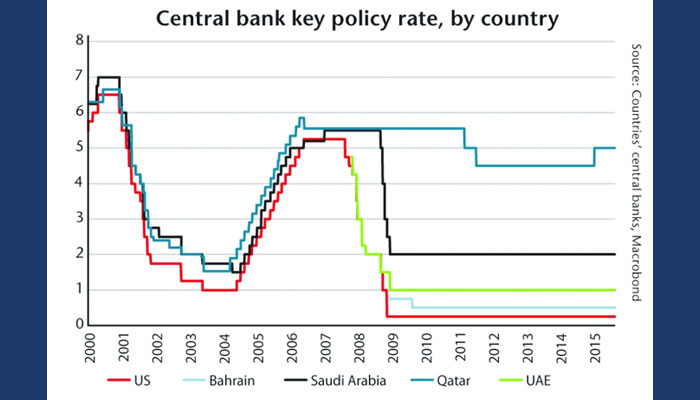

Due to the currency pegs, large interest rate gaps with the US leave the GCC countries “vulnerable to destabilising” capital flows. This is why countries with pegged currencies have moved their interest rates closely in line with the Fed.

As the US begins the process of gradually increasing interest rates, the GCC countries may have to follow its path.

In fact, raising interest rates at a time when economic growth is already being dragged down by lower oil prices is not ideal. A potential decoupling of the monetary policy cycles in the US and the GCC would make it more difficult to maintain currency pegs in the future.

Several impacted countries, such as Saudi Arabia and the UAE, have stated as recently as September that they are committed to keeping their currencies pegged to the dollar.

In the short term, this will be feasible if the rate rises in the US are gradual, as expected. However, in the medium and long term it is more likely that the GCC countries will want to take advantage of greater exchange rate flexibility, ICAEW said.

But to do so, it said, there are three primary options.

First, follow the Kuwait route and establish a peg to a basket of currencies, thereby reducing fluctuations.

Second, establish a common regional currency that oil prices and revenues could be denominated in – this is already being considered. This would involve a lot of cross-national cooperation and synchronisation – something that has proven difficult to achieve.

And third, allow currencies to float. This would allow the greatest degree of monetary policy flexibility but could also deter some investors looking for exchange rate certainty. Floating currencies would also add complications to oil pricing which is conducted in dollars.

“As such, this remains an unlikely scenario for the moment,” ICAEW said.

Due to the currency pegs, large interest rate gaps with the US leave the GCC countries “vulnerable to destabilising” capital flows, says ICAEW. This is why, it said countries with pegged currencies have moved their interest rates closely in line with the US Federal Reserve.