Reuters

New York

An autumn credit crunch was expected to hit many independent US oil producers, starving the industry of billions of dollars and further denting company budgets and drilling plans.

But banks that adjust their loans to energy companies every six months based on the oil price and volumes of reserves were more lenient than many expected this time, leaving producers with more cash for drilling and allowing them to supply more oil to a market already flush with excess crude.

The biannual process, known in the industry as redetermination, shaved only 4% off bank loans to oil and gas companies, according to a Reuters analysis of loan data, surprising experts who had expected deeper cuts because of a protracted oil price rout.

It offers cash-starved energy firms a lifeline right when oil prices are back near six-year lows around $40 per barrel because of global oversupply.

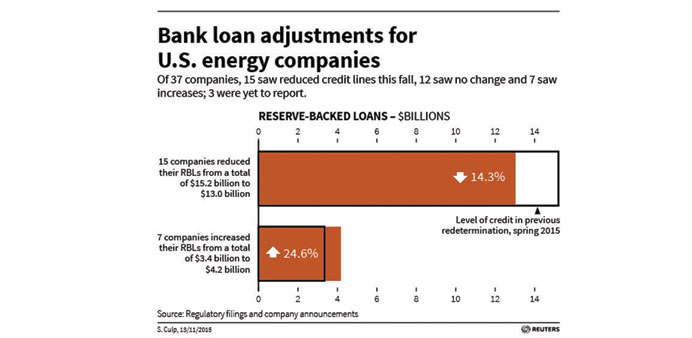

Of the 37 US oil and gas producers tracked by Reuters that hold credit lines backed by their reserves, 15 had credit reduced, seven saw an increase and 12 saw no change. Two said they expected to keep their credit unchanged and one said it expected a reduction.

In total, the producers retained access to $30.7bn in credit this fall, $1.4bn less than in the spring.

“Is anyone looking to ring the death knell for the energy industry?” asked Thomas Rinaldi, institutional investor service director at global energy consultancy Wood Mackenzie. “I don’t think so.”

The cuts were less steep than many had expected in part because banks were encouraged by producers’ hedges that locked in higher prices, their ability to cut costs during a downturn and increases in production.

Lenders at large were also more lenient than Wells Fargo, the nation’s fourth largest bank, which said in October it had cut energy credit lines by 15% on average, priming some analysts to expect similar lending cuts across the industry.

“If credit lines stay strong, companies will keep drilling and keep inventories higher and oil lower,” said Chris Metcalfe, director of finance and investor relations at Gran Tierra Energy, a small conventional oil producer which had its credit line increased by $50mn to $200mn in September.

“We wanted to push the banks as far as we could, in case we needed it in the future,” he said.

While the company has not drawn on the credit yet, Metcalfe said, it needed the extra funds to think about possible expansion.

“We wanted it there in case we needed it for acquisitions,” he said.

Others expressed similar sentiment.

“You won’t see as much of a drawdown in capital expenditure as if there was a 15-20% drop in borrowing bases,” said Nicholas Bobrowski, chief financial officer at EV Energy Partners, a US oil and gas producer whose credit lines rose by $125mn to $625mn this fall.

EV Energy Partners’ ability to borrow increased in part because of an acquisition completed on October 1 and the favorable ratio between the amount of oil it owns in the ground and how much it produces, Bobrowski said. A slide in oil prices from over $100 a barrel last year has slashed revenues, making loans an essential source of capital for many companies and the bi-annual redeterminations a make-or-break event for their operations.

The ultimate impact of loans on US oil output this winter will largely depend on the price of oil, which is determined by many factors beyond US producers’ control, such as exports from the Middle East and the strength of the global economy.

Some analysts say independent US producers will have limited impact on overall US oil output or prices. Factors such as expiring hedges which may make drilling uneconomical in some areas, can work to offset the impact of any credit-fuelled additional supply.

Even drillers whose credit lines have increased this fall have not committed themselves to more drilling while crude prices remained stuck near six-year lows.

Banks’ leniency this fall, however, does undermine one of few factors supporting oil markets: the view that small companies, starved of cash, will go under in droves.

“It makes for oil to stay at low levels,” said Rinaldi. “The companies aren’t flush, but they aren’t starving. That speaks for the rig count to stay low but not go much lower.”

The US oil rig count now stands at 574, one third of the 1,568 rigs operating a year ago. Meanwhile, oil production, remains stubbornly high near record levels above 9mn barrels per day.

The production outlook also depends on the next set of redeterminations six months from now.

The potential impact is clear. Struggling energy producer Exco Resources, which had its credit lines cut by over 37% on October 20, a week later announced that it halted drilling in the Eagle Ford shale in South Texas.

“If commodity prices are still low it will be worse in the spring,” said Leo Mariani, oil and gas analyst at RBC Capital Markets. “It could be more like a 10% drop.”