By Pratap John

Chief Business Reporter

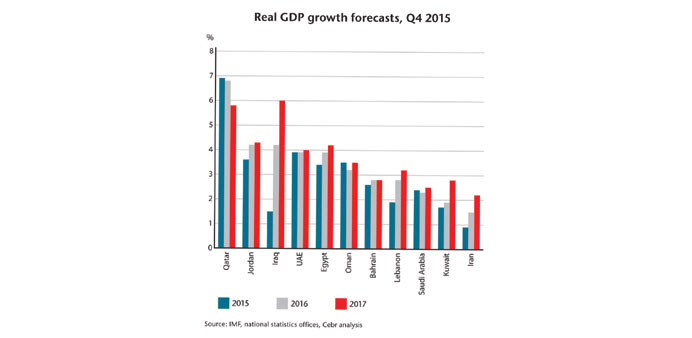

Qatar is expected to grow 6.8% next year as the country’s economy will be fuelled by substantial infrastructure investment including rail network improvements and reservoir construction, a new report has shown.

Many of the planned construction projects are related to the 2022 FIFA world cup, points out Cebr, partner and economic forecaster of The Institute of Chartered Accountants in England and Wales (ICAEW).

In September, the country’s finance minister repeated that, despite spending cuts in neighbouring countries, Qatar has no plans to scale back on any of its major programmes, it said.

Despite global economic uncertainties — prompted by lower oil prices, rising US interest rates, the Chinese slowdown and the lifting of Iran sanctions — GCC countries are better-placed than many parts of the world, the report said. They can expect continued strong, if slightly slower, growth going into 2016 according to a new ICAEW report.

Lower oil prices are significantly changing public spending patterns across the region and households and businesses should brace themselves for fewer giveaways. A combination of diversification and drawing on financial reserves will allow oil-exporting GCC countries to continue their economic growth plans in the short term. However, strong performance down the line will require reconsideration of both public spending priorities and sources of government revenue.

The Bahraini government no longer subsidises meat prices and similar measures are being implemented for fuel, electricity and water. The UAE has also eliminated fuel subsidies. Qatar has no immediate plans to either reduce subsidies or cancel funding of state-backed projects.

Nina Skero, ICAEW economic adviser and economist at Cebr, said: “Given the unforeseen extent of the fall in government revenue, it will be difficult for oil exporting countries to stick to their current obligations. Further public spending reforms are likely to be necessary but, if this transition is handled in a timely and gradual manner, strong economic growth across the GCC should continue.”

With the US Fed preparing to raise interest rates in the coming months, maintaining currency pegs is likely to be more difficult for GCC countries. Large sovereign wealth funds and trade surpluses mean GCC countries are better positioned to withstand monetary policy tightening in the US. However, any significant interest rate gaps will leave GCC countries vulnerable to destabilising capital flows.

“As the US gradually increases interest rates, the Middle East may have to follow its path. This is not an ideal scenario when economic growth is already being dragged down by lower oil revenues. A potential decoupling of the monetary policy cycles in the US and the GCC would make it harder to maintain currency pegs,” the ICAEW report said.

The slowdown in the Chinese economy at a faster-than-anticipated rate also poses challenges to commodity-exporting GCC nations. In 2013, nearly 12% of Middle Eastern exports were sold to China. Several governments in the region and numerous businesses are also in the process of shifting their investment focus eastward.

In April, Qatar opened the first centre among GCC states for clearing Yuan-denominated transactions with the aim of boosting economic links between China and the Middle East. The Chinese slowdown may have curbed the enthusiasm of local governments and businesses to deepen trade links with the country. However, establishing closer ties with the Far East does remain a viable economic growth strategy for the GCC, as long as appropriate levels of caution are exercised.

As international sanctions on Iran are gradually lifted, the country’s oil will begin competing more with other exporters, intensifying the need for public spending reviews. However, the opening of the market will also create numerous opportunities for businesses across the GCC. Firms considering entering the market should keep in mind that even with sanctions relief, it will take time for the country to adjust to an increase in international business activity. Additionally, not all restrictions against Iran will be lifted, meaning that many firms will continue to have a limited capacity to work in the country.

ICAEW regional director (MEASA) Michael Armstrong said, “It has been a tumultuous year for the global economy, and the GCC countries are not immune from these pressures. Global growth forecasts have been cut, but the economic diversification strategies of the GCC governments should see the Gulf States weather the slowdown better than other parts of the world. However, they will need to continue to review sources of revenue and reassess their spending priorities.”