Reuters

London

After several false dawns in emerging market equities, some big asset managers reckon it could be time to start buying even if the sector’s recent rally looks fragile.

Once-booming emerging markets have underperformed their developed peers for five years running. Investors who bought into the sector five years ago would be sitting on a 6% loss now if they tracked MSCI’s benchmark index. By contrast, an investment following the US S&P500 would have returned 13%, asset manager Blackrock notes.

A convincing reversal on emerging markets is still some way off. Morgan Stanley data showed this week that companies in the sector will miss analysts’ earnings forecasts for the 12th quarter out of the past 14. Many big emerging economies such as Brazil and Russia are in recession while growth in others has slipped to multi-year lows.

Nevertheless, some funds are cautiously upping their allocations. UBS Wealth Management, for instance, has gone neutral weight on emerging markets after being underweight for more than a year. That means its allocations are now on par with emerging stocks’ weight in world benchmark indexes.

“It is not yet time for emerging market bulls to run loose, but a more balanced stance may be warranted,” said Jorge Mariscal, the company’s head of the EM investment office.

Investors worldwide pared net underweight positions on emerging market (EM) stocks to 28% in October from a record 34% the previous month, according to Bank of America Merrill Lynch’s monthly survey.

Emerging equities rose 7% last month after five straight months in the red. Hints of more central bank money-printing to stimulate the economies of Japan and the euro zone helped, as did a belief that US interest rates may not rise this year. So far in November the MSCI benchmark index is up almost 2%.

Emerging equity funds started receiving new money in mid-October following $50bn in outflows in July-September, although flows have since stalled after hitting 16-week highs at the end of last month.

UBS Wealth Management said “attractive” stock valuations and tentative signs of stabilisation in data from emerging economies had encouraged the change.

Bearish positions had hit extremes in markets such as Brazil where UBS has raised holdings to prepare for a bounce.

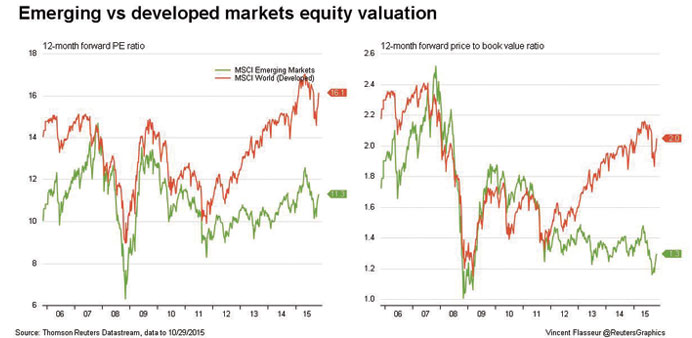

The index as a whole trades around 11 times forward earnings of its constituent stocks. This is off lows hit in recent years but considerably cheaper than developed market valuations of almost 16 times earnings.

Cheap share prices are probably justified, given the four-year recession in emerging corporate earnings, but 10-30% depreciations of most emerging currencies against the dollar this year mean that economic adjustment in many countries is already underway, some argue.

Gerardo Rodriguez, Blackrock’s head of multi-asset emerging markets, said his top investment idea is to raise EM equity holdings versus developed markets, betting that as the US economy picks up, many emerging economies will ride along.

“Looking at valuation metrics, there is clearly an interesting entry opportunity, especially against developed markets which have been rallying for years,” Rodriguez said. “We are saying it is time to look again at EM ... It is time to at least go back to benchmark (weight)”.

But after the false starts over the past five years, fund managers are wary of big positions in a sector that is so tied to the fortunes Chinese economic growth, world trade and US interest rates.