Reuters

London

Eurozone private business growth remained tepid last month but activity in China’s services industry expanded at its fastest pace in three months, easing concerns about persistent weakness in its economy, surveys showed yesterday.

There was little sign the European Central Bank’s massive stimulus programme was boosting economic activity or price pressures in the bloc, and the survey showed firms returned to price-cutting last month to drum up trade.

“Broadly speaking the economy seems to be doing okay, but the real concern is that inflation remains subdued and it will take longer to get it back to target,” said Ben May at Oxford Economics. “Against that backdrop, more policy action may well be appropriate.”

The ECB, which wants inflation of just below 2%, has been injecting €60bn a month of new money through its bond-buying programme since March to support growth and inflation in the 19-country currency area.

But with a slowdown in China and energy prices continuing to fall, ECB President Mario Draghi said on Tuesday policymakers would review the monetary stimulus and may beef up the programme at the bank’s next meeting in December.

Economists polled by Reuters last week said it was highly likely the bank would ease again, increasing or extending its stimulus programme and further cutting the deposit rate, already in negative territory.

Beijing has also rolled out a flurry of support measures since last year to avert a sharp slowdown, including slashing interest rates six times since November 2014 and lowering the amount of cash banks must hold as reserves four times this year.

Such policies have been slower to take effect than in the past, however, and some economists expect Beijing to roll out more support in coming months.

Although China’s Caixin/Markit services Purchasing Managers’ Index (PMI) rose to 52.0 from September’s 14-month low of 50.5, comfortably above the 50 level that denotes growth, a sister survey earlier this week showed the country’s colossal factory sector shrank. Xinhua news agency quoted China’s president as saying the country can maintain annual economic growth of around 7% over the next five years but there were uncertainties, including weak global trade and high domestic debt.

China’s economy grew 6.9% between July and September from a year earlier, dipping below 7% for the first time since the global financial crisis, though some market watchers say real growth rates are much weaker than government figures suggest.

Yesterday’s relatively positive economic data and the ECB’s fresh pledge to ramp up stimulus if necessary nevertheless helped set up global equities for a third straight day of gains.

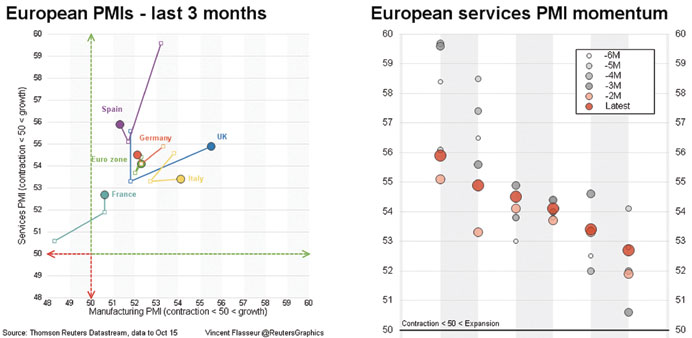

Markit’s final October Composite PMI for the eurozone came in at 53.9, weaker than an earlier estimate of 54.0 but above September’s four-month low of 53.6. The index has been above the 50 mark denoting expansion since July 2013.

Compiler Markit said the surveys pointed to quarterly economic growth of around 0.4%, in line with the forecast in an October Reuters poll.

Worryingly for ECB policymakers though, the survey showed firms returned to cutting prices to drum up business last month. The composite output price index fell to 49.6 from September’s 50.0.

Eurozone industrial producer prices recorded the steepest annual decline since January in September and consumer prices were flat year-on-year in October, maintaining pressure on the ECB to further loosen monetary policy.

In Britain, which doesn’t use the euro, services companies rebounded more strongly than expected last month, suggesting economic growth picked up speed as the final quarter began.

The Markit/CIPS UK services PMI, rose to 54.9 from September’s 28-month low of 53.3, above the 54.5 forecast by a Reuters poll of economists.

While no change in policy is expected from the Bank of England when it meets on Thursday, economists think it will raise rates from record lows in the second quarter of next year.

“The BoE pays significant attention to the purchasing managers’ surveys and the Monetary Policy Committee are likely to be encouraged by the overall October improvement,” said Howard Archer at IHS Global Insight.