AFP/New York

The US economy cooled in the third-quarter but underlying consumer demand remains strong as the Federal Reserve considers its first interest rate hike in nine years.

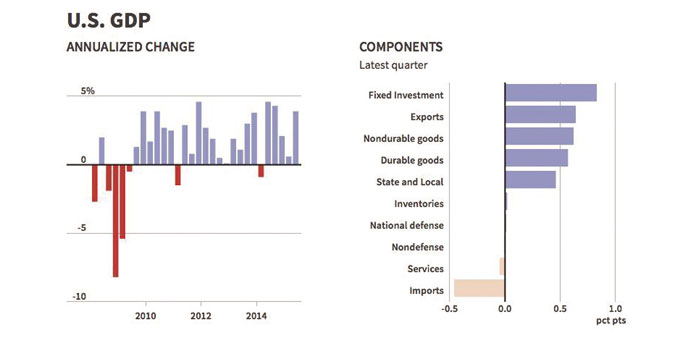

The Commerce Department reported yesterday that gross domestic product – the broad measure of goods and services –expanded at an annual rate of 1.5% in the July-September period, following a robust 3.9% pace in the second-quarter.

“That subpar number should not be mistaken for slower underlying growth. Much of the weakness stemmed from the onset of a long-awaited correction to private inventories,” said Nariman Behravesh, chief economist at IHS.

In a positive sign, third-quarter growth mainly reflected solid consumer spending, which accounts for two-thirds of US output, as consumers found themselves with a lot more disposable income than in the second quarter.

Consumer spending rose at an annual rate of 3.2% in the third-quarter, slowing somewhat from a 3.6% increase in the prior quarter. Consumers were not only buying automobiles, as seen in robust sales reported by automakers, but were spending more on furniture, housing and utilities, and healthcare.

“The consumer is driving growth in a major way, which is reflected in the data,” said Jason Schenker of Prestige Economics. “We believe consumption is likely to remain strong in Q4 and in most, if not all, of 2016.”

Disposable personal income jumped 3.5%, nearly three times the gain in the second-quarter, suggesting a promising set-up to the fourth-quarter holiday shopping season.

A downturn in private inventory investment was a large drag on GDP, the department said, noting declines in investment in wholesale trade and in manufacturing, particularly amid reduced oil drilling as companies scale back exploration in the face of falling oil prices.

The slowing global economy weighed on trade. Exports, under pressure from a strong dollar, rose a modest 1.9%, compared to the 5.1% increase in the second-quarter.

Imports, which take away from GDP growth, were also slower, rising 1.8%, nearly half the prior quarter’s increase.

The White House pointed out that economic growth in the quarter partly reflected “volatile transitory factors”. “Personal consumption continued to grow at a solid pace,” said Jason Furman, chair of President Barack Obama’s Council of Economic Advisors. “Over the past year, slowing global demand has been a headwind for the US economy.”

The GDP data came a day after the Federal Reserve signalled it could raise its key interest rate for the first time since 2006 in December if it decides the economy is strong enough to weather the tightening. The Fed has kept its benchmark federal funds rate pegged near zero since late 2008 to support the economy.

“The (GDP) slowing had been flagged well in advance by the monthly business surveys and higher frequency data, and is therefore unlikely to have a major impact on policymaking,” said Chris Williamson of Markit.

“Instead, the Fed will be firmly focused on how the fourth-quarter is playing out, writing off some of the third-quarter weakness as temporary.”

Consumer prices weakened substantially in the quarter under pressure from falling oil prices. The personal consumption expenditures price index, the Fed’s preferred inflation measure, rose at an annual rate of 1.2% in the third-quarter after a 2.2% rise in the prior quarter.

Stripping out food and energy prices, core PCE prices rose 1.3%, well below the Fed’s 2.0% inflation objective, after a 1.9% increase in the second-quarter. Growth in the economy has been volatile this year, with the first quarter mustering only a 0.6% rise amid severe winter weather and a West Coast ports shutdown. Overall, growth has been slower in 2015 than the previous year. The economy averaged 2.0% expansion in the first three quarters, below the 2.4% pace for 2014.