Indonesia tax incentives absent from Islamic banking road map; Malaysia broadened tax break for sukuk sales in 2016 budget

Bloomberg

Kuala Lumpur

Indonesia’s ambitions to rival Malaysia as an Asian Islamic finance hub are shrinking along with its Shariah-compliant banking assets.

While Indonesia is host to the world’s biggest Muslim population, Malaysia’s government has been more aggressive in supporting the industry and announced further tax breaks for sukuk in last Friday’s budget. The Jakarta-based Financial Services Authority said the nation’s Islamic banking assets fell 27% to 200tn rupiah ($14.7bn) in the first eight months of 2015 from a year earlier, while those of its neighbour rose 13.7% to a record 672.6bn ringgit ($158bn).

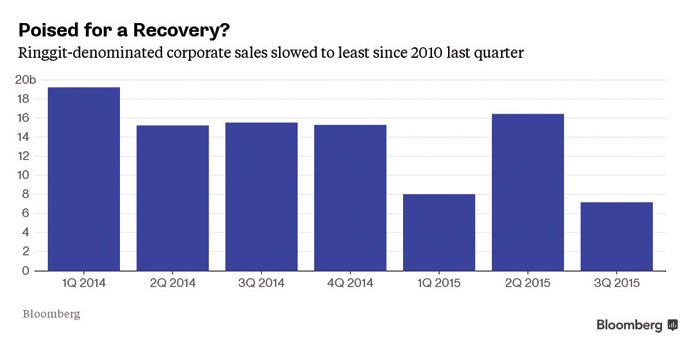

Malaysia’s corporate Islamic debt sales are measured in the billions of dollars compared with millions in Indonesia, where OCBC Al-Amin Bank Bhd says the industry is too focused on retail banking, leaving it more vulnerable to the global slowdown. President Joko Widodo was forced to reshuffle his government amid policy U-turns and wrangling among regional authorities as he seeks to make good on a pledge to boost the economy in his first year in office.

“We have yet to see the incentives that Indonesia said it was planning at the end of last year,” said Abas A Jalil, chief executive officer at Amanah Capital Group Ltd in Kuala Lumpur. “The continuation of incentives for Islamic banking in Malaysia given by the government are a key factor for the industry’s growth.”

While both countries have infrastructure investment programmes, Malaysia is a step ahead in encouraging sukuk sales to fund projects. It broadened tax exemptions to environmentally friendly Shariah-compliant bonds in its 2016 budget, while Indonesia has yet to reveal similar incentives as part of an industry road map.

Widodo has put in place a 5,519tn rupiah development programme to build roads, railways and power plants but companies in Southeast Asia’s biggest economy have only sold the equivalent of $81mn of local-currency sukuk this year. Issuance from its neighbour in 2015 totals $8bn and includes Shariah-compliant bonds in support of Prime Minister Najib Razak’s $444bn investment plan.

More than five years after Bank Indonesia asked the tax department to resolve the matter of double taxation on sukuk - those from capital gains and on income streams from the underlying assets - companies are still in limbo and must consult with the regulator on a case-by-case basis. Najib is giving deductions on costs associated with selling certain types of Shariah-compliant bonds through 2018 and expanded that to cover so-called socially responsible investment Islamic debt on Friday.

Eyes will be on a stimulus package due next month from the Financial Services Authority. It may include the easing of sukuk rules and the promotion of the nation’s Shariah stock index to encourage greater participation, according to an October 19 report in Investor Daily Indonesia, citing Chairman Muliaman Hadad.

Islamic lenders are also struggling to lure Indonesians, who tend to chose bank deposits more using economic parameters than religious ones, which means they have to offer higher returns, according to PT BNI Syariah.

“We estimate only about 20% of our clients choose to bank with us out of principle or for religious reasons, while the other 80% would seek higher rates even at conventional banks,” said Imam Teguh Saptono, director at Jakarta-based BNI Syariah, a unit of the nation’s fifth-largest bank. “So most of our clients are sensitive to interest-rate moves.”

While Malaysian banks are also facing a tough operating environment, the country’s Islamic banking assets climbed 8% in the first six months of the year, compared with 4% for conventional ones, said Alhami Abdan, head of corporate strategic planning at OCBC Al-Amin Bank in Kuala Lumpur.

Both nations have also faced obstacles in creating a Shariah megabank with the financial clout to compete with bigger rivals and expand an industry estimated at $2tn globally. Malaysia’s central bank first mooted the idea in 2009 and a three-way merger to do that collapsed this year. Indonesia has been trying to establish one since 2013.

“The general sentiment is that it will be a challenging period for the Islamic finance industry worldwide in 2016,” said Alhami at OCBC Al-Amin Bank. “Indonesia’s market still possesses good potential to continue its Shariah banking growth.”