Bloomberg/London

When it comes to deciding how much to charge Asian oil buyers, Opec members are showing little regard for tradition.

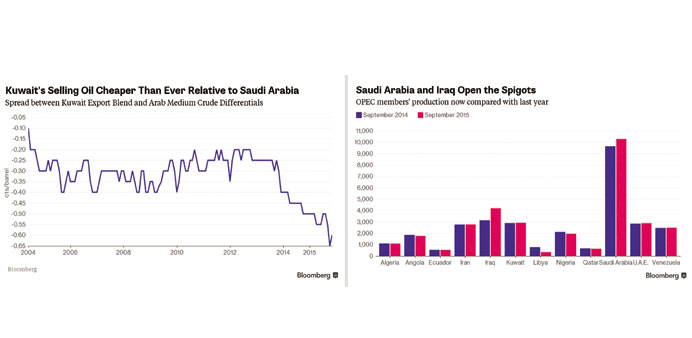

Suppliers from the Organisation of Petroleum Exporting Countries have long moved in lockstep, raising or lowering prices in tandem. Now, Kuwait is undercutting Saudi Arabia by the most on record and Iraq is also selling its oil more cheaply than the group’s biggest member. Qatar is pricing cargoes at the biggest discount in 27 months to competing crude from the UAE’s Abu Dhabi.

While the group that accounts for about 40% of global oil supplies maintains a collective strategy of flooding the market with crude, the semblance of unity has vanished when setting monthly selling prices. With Asia forecast to account for most of the growth in global oil demand this year, competition for the region’s buyers is trumping historical allegiances.

“It’s a full-on fight for market share within Opec,” said Virendra Chauhan, a Singapore-based analyst at industry consultant Energy Aspects Ltd. “That’s even as the group tries to fend off a rise in non-Opec production from countries such as Russia, Brazil and the US.”

The battleground is the Asia-Pacific region, which will account for about 34% of global oil demand in 2015, according to the latest monthly report by the International Energy Agency. China alone will be responsible for more than a quarter of consumption growth next year, the Paris-based group forecasts. The nation is importing near record amounts as it takes advantage of low prices to fill its stockpiles.

Kuwait’s official price for its Export Blend crude to Asia was a record 65 cents cheaper than Saudi Arabia’s similar- quality Arab Medium crude in October and 60 cents for November. The difference has widened from 40 cents at the beginning of 2014.

Iraq’s selling its Basrah Heavy grade $3.70 a barrel below Saudi Arabia’s Arab Heavy variety, the biggest discount since April when Iraq started marketing the oil. Qatar Land crude is $1.20 a barrel cheaper than Abu Dhabi’s Murban, the most since official selling prices were set for June 2013, according to data compiled by Bloomberg. The spread was as narrow as 40 cents in May.

As they seek to cement relationships with long-term customers, Opec producers including Saudi Arabia are competing among themselves, as well as with suppliers from outside the group, according to Bob Fryklund, the chief upstream strategist at IHS Inc.

“That’s why you saw some of those discounts, relative to other crudes in the world,” he said in an October 8 interview in Tokyo. “They continue to try to build those relationships.”

Oil prices collapsed to the lowest in six years in August as Opec responded to a surge in supply from US shale fields by opening its taps in an attempt to price higher-cost producers out of the market. Opec said it pumped the most crude in three years in September, led by output gains in Iraq.

The strategy has worked to the extent that US production dropped as the falling prices spurred oil drillers to sideline more than half the country’s rigs in the past year. Output is down over 500,000 bpd from a more than three-decade high of 9.61mn reached in June, weekly Energy Information Administration data show.

It has been costly for Opec members that are dependent on oil revenue to balance their books. Saudi Arabia, which relies on oil for most of its revenue, is expected to post a budget deficit of almost 20% of gross domestic product this year, according to the International Monetary Fund.

Brent futures have fallen 15% on the London-based ICE Futures Europe exchange this year. Opec’s own basket price, representing the main export crudes of all member countries, is about 14% lower in 2015.

While Opec predicts improving demand for its oil next year, there may be more supply from one member. Iran, Opec’s fifth biggest producer, may boost output to 3.6mn bpd within six months if international sanctions against the country are eased, the IEA said on October 13. The nation pumped 2.8mn bpd in September, data compiled by Bloomberg show. The additional supply may end up replacing similar grades from Saudi Arabia, Iraq or Russia, the agency said.

“There will likely be much more competition within Opec when Iranian exports increase,” said Ehsan Ul-Haq, a London-based analyst at industry consultant KBC Advanced Technologies. “If Iran exports continue to go up, it will need to adjust its official selling price to be more attractive as compared with other similar grades.”

Opec will keep oil output high: Traders

Reuters/London

Saudi Arabia and the other big Middle East oil producers in Opec will keep pumping hard to build market share despite mounting over-supply that has brought prices to six-year lows, the world’s top traders say.

The Organisation of the Petroleum Exporting Countries probably will not change tack and trim output even if it means prices stay low for a long time, senior executives from Vitol, Trafigura and the other big commodities houses said.

“I’m expecting Opec to be quite consistent in this position,” Trafigura chief financial officer Christophe Salmon told the Reuters Commodities Summit.

Opec ministers meet in Vienna on December 4 to decide production policy and are likely to see sharp disagreements between Gulf countries with low production costs and poorer members such as Venezuela that need higher prices to meet their budgets.

Caracas has proposed that the group, source of more than a third of the world’s oil, adopt a price band with a floor around $70 a barrel and has suggested Opec and non-Opec producers cooperate to support prices.

Venezuela, Nigeria, Algeria and several other Opec members need oil prices well over $100 barrel to cover their costs - twice the current crude price below $50.

But core Opec members in the Middle East have much lower costs and are more worried about losing market share to shale producers in the North America. They hope lower prices will squeeze out their competition and boost prices in the long term.

“There is bound to be a huge amount of pressure on the Saudis from one or two people at that meeting to look at this policy again,” said Ian Taylor, chief executive of Vitol, which traded more than 2bn barrels of oil last year. “I cannot believe they will want to change their strategy at this moment in time, but you can’t rule it out totally ... I never like to pre-judge an Opec meeting. You do that at your peril,” he said, adding: “Do I expect a change? Probably not.” Gunvor chief executive Torbjorn Tornqvist agreed, saying the group was unlikely to cut production any time soon.

Marco Dunand, chief executive of trading house Mercuria said Opec had decided to let prices find their own level. “The way they’re looking at it, they’re saying in the longer term, you better let the market rule the price, Dunand said.

“That’s their new philosophy,” he added: “The price is curing the problem.”

The trading companies also think that Opec can probably manage to make some space for Iran, which looks set to increase output early next year after sanctions, imposed over its nuclear programme, are lifted.

Tehran says it can raise output by 500,000 bpd in the first week after sanctions are lifted.

Iran may be optimistic but traders say it will certainly accelerate oil sales rapidly once foreign investment is allowed to return. Sanctions halved Iran’s oil exports to around 1.1mn bpd from a pre-2012 level of 2.5mn bpd.

And it is likely to cap oil prices, that Taylor said would struggle to trade above $60 a barrel next year.